Technology is literally at the point where it is disrupting almost everything and this week has been a prime example of this trend. On the one hand Google co-founder Sergey Brin was revealed as the investor behind growing synthetic meat in a lab in order to disrupt the cattle business and Elon Musk proved he can disrupt the auto market with his successful launch of Tesla Motors and the recent public acceptance of his company’s vehicles which surpassed analyst estimates.

Can you disrupt a commodity though? After some consideration I would assert you can and this post will explore the top reasons why Bitcoins are better than gold.

1) The Silk Road underground market has eagerly embraced the Bitcoin currency for trading legal and illegal products such as drugs and the DEA recently started to go after such activities and even seized some Bitcoins in a raid this past June. It’s not just Silk Road – other “deep web” websites have also embraced this currency. Of course, the author is not condoning any illegal activities – but he does believe it is worth pointing out you will have a tough time using gold bullion to purchase products and services on these networks.

2) Negotiating Customs can be a time of stress for people with large amounts of cash which is supposed to be declared as you move from country to country. Even if you aren’t breaking the law, international travel comes with a feeling of being at the mercy of an authority figure that doesn’t sit well with many people. According to the US Customs and Border protection:

When entering the U.S. in-transit to a foreign destination, you will be required to clear U.S. Customs Border Protection (CBP) and Immigration and Customs Enforcement. If you have “negotiable monetary instruments” (i.e. currency, personal checks (endorsed), travelers checks, gold coins, securities or stocks in bearer form) valued at $10,000 or more in your possession a “Report of International Transportation of Currency or Monetary Instruments” form FinCEN 105 must be submitted to a CBP Officer upon your entry into the United States.

If you have Bitcoins stored in an app on your mobile phone, it would make sense that you will need to comply with this requirement. Especially in light of the recent court ruling that Bitcoins are indeed cash equivalents. But what if the Bitcoins are in the cloud? Or if you delete the application temporarily as you cross the border? Of course there are IRS rules in play here which would likely require you to declare the money and this post is not meant to be legal advice or to condone illegal activity. Still, it is worth pointing out the tremendous grey area here.

3) Lower transaction fees are certainly a major benefit of using Bitcoins as you travel around the world. Assuming you are able to use your Bitcoins as currency wherever you go, the need to pay high fees to exchange tellers will be dramatically reduced if not eliminated. Likewise for ATM and credit card fees which put you at the mercy of bank rules and regulations regarding how much they will charge you for the privilege of using your own money. In many cases, unless you plan ahead, you likely can’t even sell your gold easily as you travel and the reduced competition for your gold means you will likely not get near the going price for your coins, jewelry or other assets.

4) Bitcoins are less bulky than gold coins which means if you have been buying gold in anticipation of the global money supply blowing up because of excess government debt and money printing, Bitcoins might make a nice alternative to a pocket full of jingling metal.

5) Money laundering could be a lot easier with Bitcoins – again, we arent condoning the activity and we have touched on how virtual currency can facilitate illegal activity above. You can certainly use gold to launder money as well but you then have to verify you are actually buying gold and not all money launderers want to deal with determining how pure the gold they buy and sell is.

6) Bitcoins are gold 2.0 and what better way to pay for all the 2.0 stuff you want to buy from hamburgers to electric cars and anything else you can think of?

7) Bitcoins are cool – sure, gold can be too if you hang in a circle where expensive jewelry or dental implants made from gold are all the rage but in a world where people crave electronics – how cool is it to be able to store your bank account in an app and not on your wrists, fingers and teeth?

8) Gambling is a lot easier with Bitcoins than gold as you can transfer them electronically with ease.

9) No central processor or storage facility is needed with Bitcoins – meaning it is easy as cash to pay with, instant and verifiable. Contrast this to gold which can be stolen or lost. Its worth throwing bank accounts into this discussion as these institutions lend out the money they hold making their assets typically “virtual holdings.” In other words, if the majority of the people who made deposits asked for their money at once, the bank would collapse and your money would be lost and/or subject to repayment according to FDIC rules.

10) Micropayments are another advantage of Bitcoins… They can be divided down to fractions such as one hundred millionth of a Bitcoin. That fraction is called a “Satoshi”, in honor of the “father” of Bitcoins. By allowing currency to be divided to finer fractions, buyers and sellers have greater flexibility in sales and bartering.

11) Fraud fears decrease dramatically when you use Bitcoins as opposed to ETFs like SLV or GLD where there are critics who argue that the required amounts of silver and gold needed to back the ETF isn’t really in the warehouse or that banks are manipulating prices.

12) There is no fear of a super-mine or asteroid discovery with Bitcoins as there will never be more than 21 million of them created. Of course it may be far-fetched to think that a huge amount of gold will be discovered but there are certainly efforts underway to mine asteroids and no one knows if there are tremendous amounts of gold in the ground somewhere just waiting to be found which could dramatically increase supply and subsequently lower prices.

13) Bitcoins have no dependence on oil to keep the price stable as is the case with many commodities – especially those which require digging with machines that consume large amounts of fuel. If the price of oil were to decline as a result of increased use of natural gas or renewable energy sources, the cost to excavate gold would decrease and as a result the commodity could decrease substantially in value.

14) Bitcoins have no dependence on jewelry or electronics to keep the price stable as gold does. Assume for a moment that the world decides that gold jewelry is no longer fashionable. If this were to happen, there would be an immediate decline in the price of gold. Likewise if gold use in electronics were to decrease tremendously because of a new alternative which is better or lower in cost. These are not concerns to Bitcoin investors.

15) Bitcoins are a virtual commodity – giving you many benefits of commodities without the same drawbacks.

It should be noted that other virtual currencies have been started and have eventually failed and the public at large is not likely as comfortable with algorithmic money as they are traditional currencies. If there is demand from my readership, I may consider a follow-up on the pitfalls of virtual currencies like Bitcoin. Feel free to add your perspective in the comments.

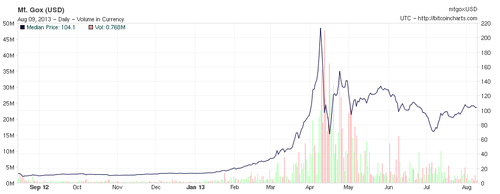

You may be interested to see how the price of the GLD (gold ETF) and Bitcoins have moved over the last year… As you can see, Bitcoins have appreciated dramatically and gold has declined.

Bitcoin chart below – the virtual currency saw significant appreciation after the Cyprus near bankruptcy which generated tremendous media coverage that helped keep this price at appreciated levels