If you listened to the financial experts after the news broke that Apple guided lower last night, phones are now commodities, Apple doesn’t know how to innovate anymore, the prices for iPhones are too high and the public has lost its obsession with smartphones.

Our collective heads almost exploded listening to this jibberish – with a minor exception we will get to at the bottom of this post.

Last year Apple made two moves totally missed by virtually all financial analysts. They released iOS 12 which is up to two-times faster than prior operating systems and they drastically reduced the cost to replace batteries.

To give a sense of what these changes means in the real world… An iPad Air 2 released on October, 2014 became a truly useable device as a result of iOS 12.

Four-year-old phones, computers and tablets are generally destined for the trash but what Apple has done by increasing the speed of its operating system is to literally make billions of devices usable again.

Another way of looking at this is the much faster processors available in later devices matter a lot less – meaning a reason for upgrading for millions of users was just eliminated.

Apple continues to tell us they want you to think of them as a service company.

They are more than this, however… They are also an ecosystem company.

Any group of people who send iMessages to iOS and Android users know that iMessages work far better when they are sent Apple to Apple as they use the IP network first, making them far more likely to be delivered. Messages also don’t cost anything to be sent, etc. iCloud and photo sharing also work far better Apple to Apple. Then there are keyboard shortcuts, etc. which sync across iOS devices.

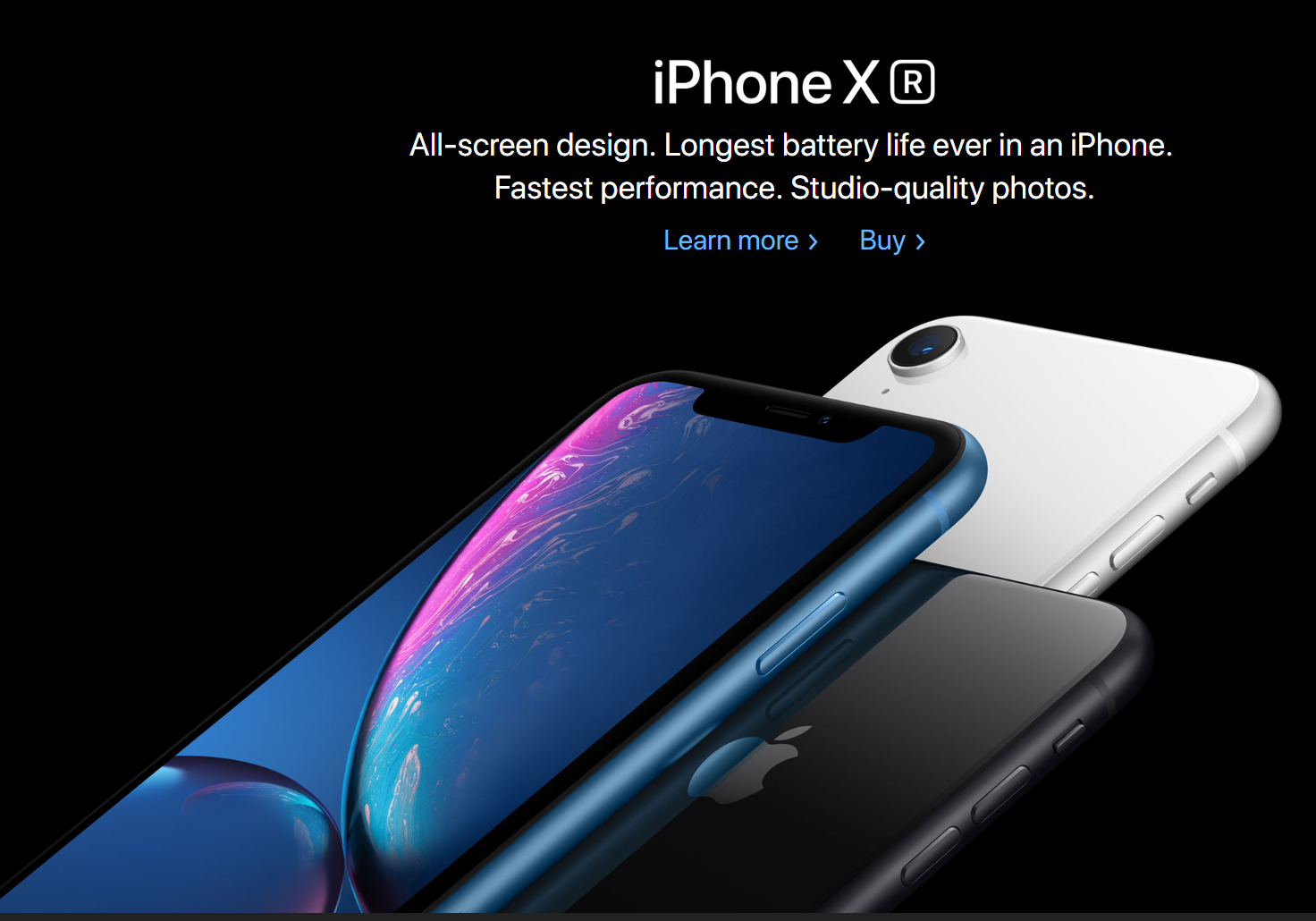

These are some of the services that keep people in the iOS family. Even as Samsung and more recently, Huawei often out-innovates Apple with curved screens and other hardware niceties.

Now that all these iOS devices are more usable, Apple will have a larger audience for Apple Music, movies, payments, etc.

This also makes it that much harder for a family or company to switch to Android.

So investors have focused on the short-term hit of Apple selling less hardware.

Apple is down as much as $450 billion in market value since its peak.

Truth be told, Apple is one of the few companies even making money in hardware. Software and services are the real cash cows as they don’t involve physical objects which need a supply chain, manufacturing, the threat of tariffs, etc.

Basically, Apple is dealing with the Fish problem which was mentioned once by David Walsh of GENBAND (now Ribbon Communications). This is classically what happens when a hardware company becomes a cloud company and makes massive investments in cloud while they have to wait for years of monthly revenue to pay for all of this investment. It is a bit different in Apple’s case but the idea is the same – less immediate hardware revenue will eventually be offset by more service revenue.

So yes, China is slowing – they purchased less phones than expected. The stronger U.S. dollar also hurt Cupertino. But over the long-term, billions of new iOS devices have become usable. In lower-cost markets this means they can use older, less costly iOS devices now.

It will take time for these new devices to add to service revenue but there is no question they will and over time patient investors should be rewarded.

This was a stroke of genius on Apple’s part but most will miss it and then marvel years from now at how Apple “surprisingly” was able to grow their services business so rapidly.