Avaya received a bid from Mitel which would take the stock to a value of over $20 a share from around $12.50 when announced.

Avaya was once the premier name in the PBX space – they were spun out of Lucent Technologies around 20 years ago because they were in a slower-growing space than the rest of Lucent which was serving the exploding CLEC market.

Then, of course, the CLEC market exploded – but in the opposite way – downward… And Avaya became the fast-growing company – relatively anyway.

But Avaya missed cloud.

In 2012 when Shoretel purchased M5 it was very very very very obvious that every customer premise equipment provider or CPE needed to have a strong cloud option.

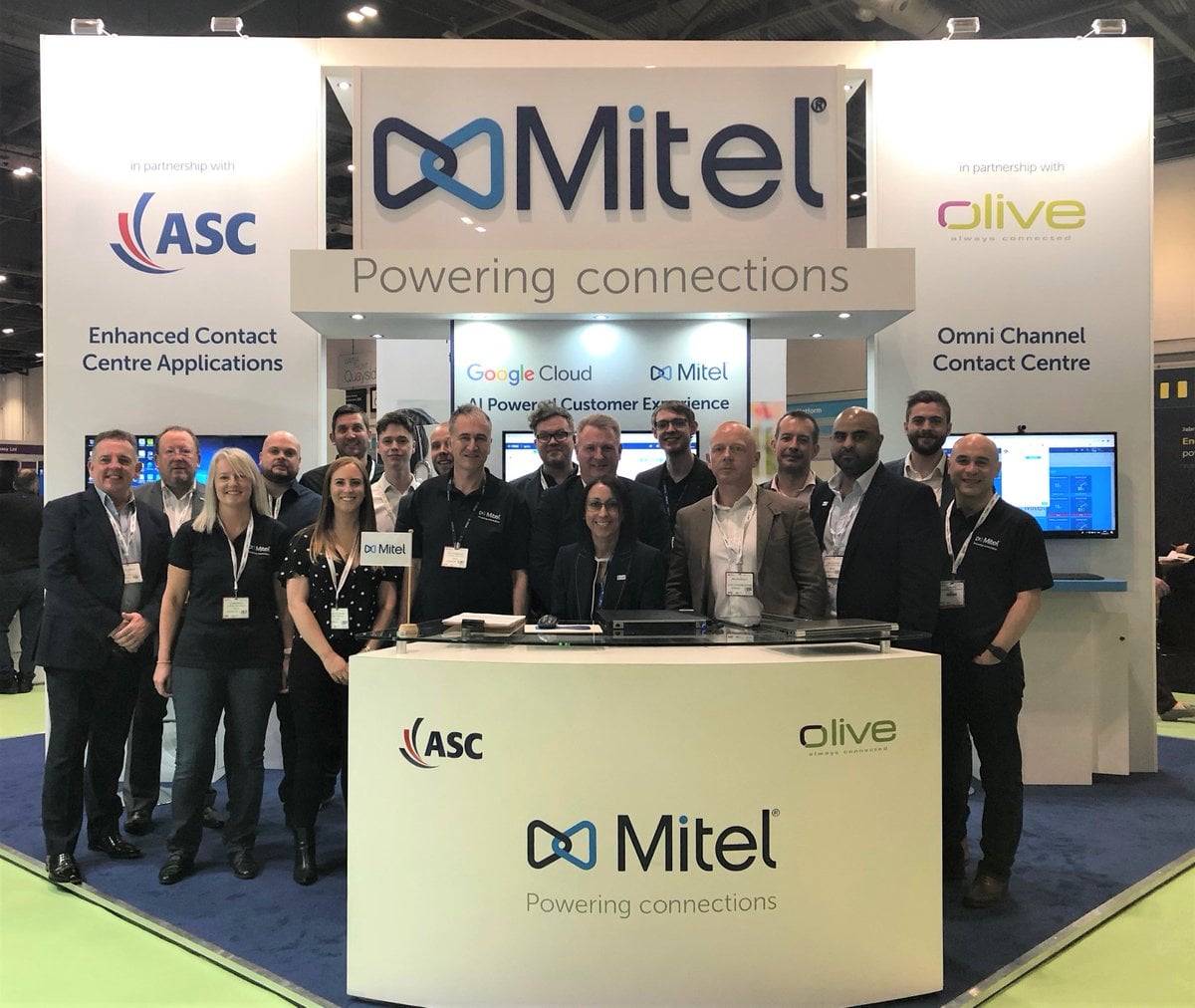

We wrote at ITEXPO in 2012 when the ShoreTel acquisition was announced that Avaya and Cisco would be buying cloud vendors. Cisco did finally buy Broadsoft and Avaya has a cloud product and is growing it but they haven’t established their brand as synonymous with cloud by any means. Mitel has done a far better job in this regard – buying ShoreTel obviously helped.

Erik Linask, Group Editorial Director here at TMC said, “On the surface, this is a good move – despite how much Mitel and competitors say they are huge in the enterprise space – they are mostly midsize and down. From this perspective, this is a logical deal. My question is, does Avaya’s existing installed base accept this transition to a company with no experience serving this kind of customer base.”

He also says this move is the best way for Mitel to take on Cisco and Microsoft.

The merger isn’t finalized and others may bid for Avaya as well but our feeling is the merger will be a good one.

We feel this way because there is obvious market fit and tremendous synergies but perhaps most importantly, Mitel CEO Rich McBee comes from Danaher and the company is very good at acquiring and integrating – we said this in 2011.

The biggest challenge though is not even the integration, it is the different mindsets of cloud developers and those who create hardware. Sure, everything is really software these days but the MRR versus CAPEX model is very different and a single company doing both means having to deal with more politics and dissent than a pure cloud vendor.

Other than that we believe the merger makes sense and is a positive for the market. We also wonder how different the market would have been if Avaya had followed ShoreTel in 2012 by purchasing one of the various UCaaS vendors.

Learn about the latest in everything you need! UCaaS, the Channel, IT, IOT, Edge, Cybersecurity, AI, SD-WAN, and the Future of Work at the world’s only SD-WAN Expo and MSP Expo, part of the ITEXPO #TechSuperShow, Feb 12-14, 2020 Fort Lauderdale, FL.