By Peter Bernstein

With all of the industry discussion around the coming tsunami of data traffic, particularly video, there has been much global discussion about necessary network build-outs to accommodate what everyone agrees is coming. This includes intense focus on the notion of shared proportionality in terms of cost causers and cost bearers. Given the criticality of the debate/discussion, Alcatel-Lucent thought it would be a good time to look at one critical component of traffic and financial flows, namely CONTENT PEERING.

A detailed analysis by Bill Krogfoss, Strategy Director for Corporate CTO, Alcatel-Lucent, in the company’s TechZine online publication proves to be enlightening. It highlights trends in ISP and Content peering with excellent descriptions of the economics of both. It then presents an economic model ALU developed to compare two views:

- The Internet economy before the rise of content peering

- The Internet economy after

The analysis lays out the assumptions that went into each of the views, and concludes with some interesting, what some might call troublesome, findings:

- Content peering has helped ISPs reduce transit costs for video traffic

- ISPs may be compelled to accept content peering because of explosive video growth

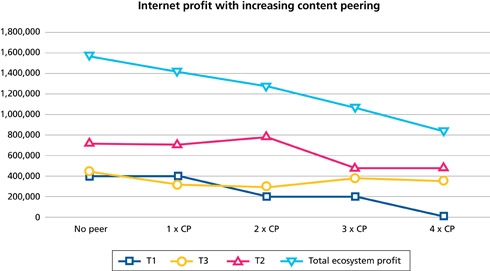

- Widespread content peering decreases profits for all ISPs in the long term

The last finding is the real grabber. In fact, as will be seen below, depending on what type of ISP you are (Tier 1, Tier 2 or Tier 3) and hence where you sit in the current environment that governs traffic and monetary flows, rate at which your profits will decrease as content peering proliferates and data traffic volumes balloon may be relatively mild over time or potentially cause for current alarm. However, no matter what type ISP, the trends are not your friends.

The analysis does state that as a result of the growth of content peering, transit expenses have fallen, actually providing temporary relief to ISPs. However, because of two unanticipated consequences short-term gain will likely result in long-term pain. Two culprits are cited:

- Lost income — Content peering allows both content providers and ISPs to reduce transit expenses it also causes ISPs to lose some income from selling transit to content providers while content providers do not lose income.

- Loss of control — Exponential video growth has put content providers in a dominant traffic position. Large content providers to mitigate transit costs have built their own networks to peering partners allowing them to place pricing pressure on Tier 2 and Tier 3 ISPs already struggling with the expenses of dealing with the traffic explosion. This will get worse over time.

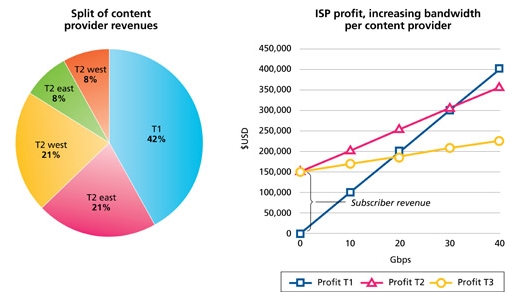

Without diving deep into the weeds of the assumptions and calculations two charts from the analysis make the point:

Internet economy before content peering

Internet economy with content peering

The analysis is careful to point out that ISPs will not become unprofitable based on the challenges presented by the long-term trend to content peering in a world with exploding data and video traffic.

However, it provides a description as to why the analysis was performed and what it can mean:

“The goal of this article is to show that inequities exist not only between ISP and content providers but also between ISPs, as ISP profits vary according to their service model and Tier level…Unless operators can recoup the lost revenues from content providers, it is likely that network operators will need to create usage caps…Differentiated Internet services would be key to enabling new cloud service paradigms and a better video quality of experience.”

This was an economic analysis, i.e., devoid of political considerations and the dynamics of the roiling market changes that are disrupting the industry structure while at the same time destroying old relationships and creating new ones.

That said, the value of the analysis is how it shines a bright light on a very serious challenge. Indeed, until the realities of the unappreciated consequences of content peering pervasiveness are fully understood and addressed, they will not just fester but will overhang the industry as it attempts to rebalance to deal with the new video-centric world that is hurtling forward at an ever accelerating pace.

A few factoids are worth considering:

- Roughly 3 billion cellular subscribers with hundreds of millions on the near-term horizon and many of the newbies and current ones wanting smartphones.

- Two-billion Internet users.

- As a corollary, the extraordinary growth of iPhone, Android and tablet sales in just the last two financial quarters.

- In May of 2010, YouTube exceeded 2 billion views per day and had blown past 24 hours of video per minute being uploaded.

Much of that traffic is asymmetric. It is why the ALU analysis is an important contribution to business and political decisions about the future.

Want to learn more about the latest in communications and technology? Then be sure to attend ITEXPO West 2011, taking place Sept. 13-15, 2011, in Austin, Texas. ITEXPO offers an educational program to help corporate decision makers select the right IP-based voice, video, fax and unified communications solutions to improve their operations. It's also where service providers learn how to profitably roll out the services their subscribers are clamoring for – and where resellers can learn about new growth opportunities. To register, click here.