Introduction

As business communication evolves, organizations must navigate a variety of choices to find the right technology that fits their needs. With the growing adoption of cloud-based solutions, businesses face the challenge of integrating their existing on-premise systems with new cloud offerings. NEC Corporation of America provides a solution, UNIVERGE BLUE, aimed at addressing these challenges. We recently discussed the features and benefits of this hybrid communication solution with Jeremy Dunegan, Sr. Manager of Strategic Partnerships, and Stephen Spencer, SVP Head of Enterprise BU Sales and VP Channel Sales Americas at NEC Corporation of America.

UNIVERGE BLUE: Bridging Premise and Cloud Communication

NEC’s UNIVERGE communications portfolio includes the SL, SV, and UNIVERGE 3C premise-based communication servers, as well as the UNIVERGE BLUE cloud/hybrid offering. This solution is designed to manage both premise and cloud communications, facilitating a smooth transition between the two.

The UNIVERGE BLUE CONNECT BRIDGE allows on-premise customers to transition to a hybrid cloud or full cloud solution, supporting investment protection and enhancing the digital transformation process by integrating mobility, messaging, video, and file-sharing features with existing NEC premise systems.

Although the UNIVERGE BLUE CONNECT BRIDGE shares some similarities with the UCaaS license, it does not offer SIP trunks. The solution can also integrate with collaboration tools such as Microsoft Teams, Office 365, and Slack.

The adaptability of UNIVERGE BLUE creates opportunities for resellers to offer cloud services to phone customers, even if they are using another partner’s services. Technology services distributor Telarus is working with NEC to enable these new sales opportunities.

The Future is Hybrid

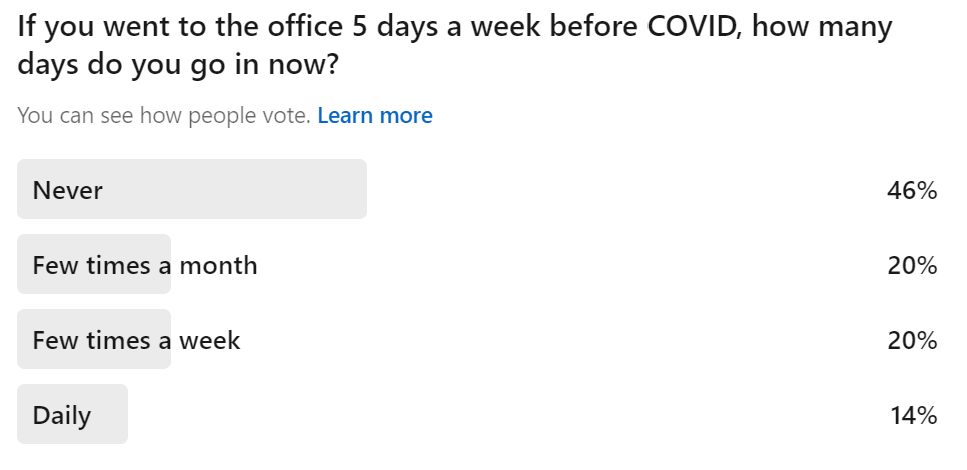

A recent LinkedIn poll we conducted indicates that, as of this writing, more than 80% of workers who went to the office daily before COVID are now either fully remote or hybrid.

NEC’s Market Position

Founded in 1899, NEC Corporation is a multinational information technology and electronics company. NEC has managed to maintain financial stability in the dynamic technology sector by focusing on core businesses and diversifying its portfolio. The company’s strategic investments in AI, data analytics, and cloud services contribute to a consistent revenue stream.

Long-term relationships with key customers and partners play a role in NEC’s financial health and position in the global technology market. The company’s emphasis on innovation and customer satisfaction helps to establish lasting partnerships with enterprises, government institutions, and service providers worldwide.

In recent years, NEC has adapted its business strategy to align with market trends and customer demands. By identifying and investing in emerging technologies, such as 5G, IoT, and AI, the company aims to achieve future growth. NEC’s management also prioritizes corporate governance and risk management to enhance financial strength and foster trust among investors and stakeholders.

Conclusion

Businesses operating in the competitive industries of communications, tech, UCaaS, CRM, call center, cybersecurity, and cloud computing need flexible and adaptable solutions that can evolve with their requirements. NEC’s UNIVERGE BLUE is one solution designed to address the integration of premise and cloud communications, offering a path for digital transformation while protecting investments. For technical purchasing decision-makers, MSPs, and communication service providers, this solution may be worth considering to address the challenges faced in the ever-changing landscape of business communication.

Aside from his role as CEO of TMC and chairman of ITEXPO, Rich Tehrani is CEO of RT Advisors and a Registered Representative with and offering securities through Four Points Capital Partners LLC (Four Points) (Member FINRA/SIPC). RT Advisors is not owned by Four Points.

Aside from his role as CEO of TMC and chairman of ITEXPO, Rich Tehrani is CEO of RT Advisors and a Registered Representative with and offering securities through Four Points Capital Partners LLC (Four Points) (Member FINRA/SIPC). RT Advisors is not owned by Four Points.

RT-Advisors continues its mission of assisting tech companies in M&A and capital raising using our unique tech media background and relationships to aid companies to optimally position themselves. In addition, as of late we have been increasingly assisting fast-growing tech companies in obtaining non-dilutive capital. Please let us know if we can be of assistance. The above is not an endorsement or recommendation to buy/sell any security or sector mentioned. No companies mentioned above are current or past clients of RT Advisors.

Aside from his role as CEO of TMC and chairman of ITEXPO, Rich Tehrani is CEO of RT Advisors and a Registered Representative with and offering securities through Four Points Capital Partners LLC (Four Points) (Member FINRA/SIPC). RT Advisors is not owned by Four Points.

RT-Advisors continues its mission of assisting tech companies in M&A and capital raising using our unique tech media background and relationships to aid companies to optimally position themselves. In addition, as of late we have been increasingly assisting fast-growing tech companies in obtaining non-dilutive capital. Please let us know if we can be of assistance. The above is not a recommendation to buy/sell any security or sector mentioned.

Aside from his role as CEO of TMC and chairman of ITEXPO, Rich Tehrani is CEO of RT Advisors and a Registered Representative with and offering securities through Four Points Capital Partners LLC (Four Points) (Member FINRA/SIPC). RT Advisors is not owned by Four Points.

RT-Advisors continues its mission of assisting tech companies in M&A and capital raising using our unique tech media background and relationships to aid companies to optimally position themselves. In addition, as of late we have been increasingly assisting fast-growing tech companies in obtaining non-dilutive capital. Please let us know if we can be of assistance. The above is not an endorsement or recommendation to buy/sell any security or sector mentioned. No companies mentioned above are current or past clients of RT Advisors.

RT-Advisors continues its mission of assisting tech companies in M&A and capital raising using our unique tech media background and relationships to aid companies to optimally position themselves. In addition, as of late we have been increasingly assisting fast-growing tech companies in obtaining non-dilutive capital. Please let us know if we can be of assistance. The above is not a recommendation to buy/sell any security or sector mentioned.