Cord cutting is real. It is affecting more than just the cablecos.

The cablecos realize that they have to switch to broadband, voice and other product lines to counter the revenue loss from TV. CableOne CEO, Tom Might, gave a presentation at Wells Fargo that follows a speech he gave a year prior.

Cable - typically residential TV - has turned to broadband and voice for extra revenue and then it turned to the small business market with the same triple play bundle. TV for any lobby plus voice and broadband has captured a large chunk of the marketplace.

Cablecos have invested in smart home security and Ethernet for businesses. There is even some interest in cellular for a Quad play. These are the emerging revenue streams for cablecos - at the expense of the incumbents.

Content providers are feeling the disruption too- in a couple of ways.

More OTT choices for the consumer means that the Big 4 networks - ABC, CBS, Comcast/NBC and Fox - don't command the audience or eyeballs they once did. That hits their pocketbook big time.

Content producers now have HBO, SyFy, Starz, Showtime, Netflix, Hulu, Amazon and YouTube to distribute their shows. Consumers have too many choices!!! In one generation - 40 years ago when I was a kid - we had 4 channels with rabbit ear antennas. Now, unlimited channels across the Internet - legally and illegally.

Then there are the cord cutters, who MSOs only recently acknowledged. Now we have slimmer TV packages from DISH/Sling, Boingo, Verizon, and cablecos. These slimmer packages mean that some channels are making less money. ESPN is the best example.

ESPN is owned by ABC/Disney. It has a stranglehold on TV distributors. Commanding not just $6-$8 per subscriber, but that the package has to include all 7 ESPN stations -- even on cable systems that cannot supply 500 channels. [The Big 6 do the same thing -- bundle crappy channels with the one everyone wants with stupid clauses and restrictions. That's right just 6 companies control 90% - and less than 300 people control what you can watch.]

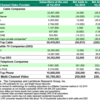

DSLR writes, "According to recent company filings, ESPN's subscriber rolls peaked at 99 million in 2013, but in just two years have dropped by roughly 7 million users to 92 million." At $6 per subscriber per month - $42M per month is $500M per year. And that is just subscriber revenue --- ad revenue will be adversely affected by this subscriber decline too. It spins down fast. Gravity takes over.

Then look at the content owners. The NFL commands $6B per year from networks, including $1.6B per year from ESPN for Monday Night Football.

Cord cutters make me laugh when they demand that the content be available without cable. How exactly would that work?

The channels (like ESPN) have the distributors (like cable) by the balls. ESPN is suing Verizon over the way it packages ESPN now. VZ broke the conditions of the carriage contract. Who will break first - the channels or the distributors?

CBS is selling its channel access for $6 per month. Even though you can get CBS with a TV antenna in most cities. [Many viewers will tell you that they miss their DVR and recording shows. You pay CBS for on-demand access.]

ESPN has to worry that if they wait too long, the NFL follows the MLB and goes straight to viewers and that $2B per year becomes part of a bankruptcy battle.

It is all disrupting. Just like the music industry. Just like the newspaper industry.

In the end, people will pay for (1) convenience and (2) user experience. Excel at one or the other.