New reports from Infonetics that I thought I'd share. They discuss how hosted VoIP services and unified communications will increase and they talk about capital expenditures on enterprise VoIP equipment. One point I'd like to highlight is they stated "Service provider revenue from residential/SOHO and business VoIP services increased 20% between 2008 and 2009, to $41.6 billion". Even in this prolonged recession, VoIP is still growing strong with no signs of slowing down! Although they also stated that in 4Q09, worldwide sales of enterprise unified communication, VoIP, and TDM equipment together only grew 3% sequentially. Also, For the 2009 year, revenue dropped 21%, from $10.4 billion to $8.2 billion. Not good.

Interesting how hosted/service provider VoIP grew by 20%, while enterprise VoIP languished with only 3%. Of course, companies that are looking to save money on short-term expenditures will look at hosted VoIP since it has a much lower upfront cost vs. purchasing an IP-PBX. The good news is that Infonetics predicts that revenue to grow in 2010, led by pure IP PBX phone systems, as worldwide economic conditions improve.

The reports also highlight how NEC and Aastra made "big gains" in the IP-PBX space. Well, Aastra is new to the IP-PBX game, so no doubt they'd see a huge percentage increase. However, NEC has been in the game awhile, so good to see them getting some market share. The more competition the better. Can't all be about Cisco and Avaya (and soon perhaps Microsoft with Wave 14 OCS)

The 3 voice over IP and unified communications reports Infonetics Research published include:

- Communication Expenditures and IP PBX Vendor Ratings: North American Enterprise Survey

- VoIP and UC Services and Subscribers, a market size, share, and forecast report tracking business and residential/SOHO (small office/home office) voice over IP services

- Enterprise Unified Communication, VoIP, and TDM Equipment, a quarterly market size, share, and forecast report (fourth quarter edition)

ANALYST NOTES

"The enterprise telephony market was hit hard in 2009 due to the recession, but based on the latest quarterly shipment figures and results from our March 2010 survey of North American enterprises about IP PBX spending, it appears that the bleeding has stopped and 2010 promises to be a better year, good news for vendors and service providers alike. From our IP PBX survey, it appears that businesses are increasingly embracing a hosted services model, as their capacity needs will depend on how robust the economic recovery is, and hosted services allow them to more easily ramp their capacity needs up and down without a huge cash layout for equipment," notes Matthias Machowinski, directing analyst for enterprise voice and data at Infonetics Research.

Diane Myers, directing analyst for service provider VoIP and IMS at Infonetics Research, adds: "VoIP services sold to the residential/SOHO market still make up the lion's share (about three-quarters) of total VoIP service revenue, but we saw a pickup in business VoIP service revenue growth in late 2009 and service providers report that they are seeing increasing interest in hosted VoIP services across all sizes of businesses, including large enterprises. We expect this trend to continue as more companies turn to hosted services for their voice needs, with business VoIP services making up almost a third of all VoIP service revenue by 2014."

IP PBX ENTERPRISE SURVEY HIGHLIGHTS

- Most phone extensions today are delivered via IP PBXs, having out-shipped TDM PBXs for years, and are finally taking up a sizable share of the installed base

- Businesses expect to increase their phone extensions at a slightly higher-than-normal growth rate over the next 2 years (15%), which can be attributed to hiring and growing following the recession

- Virtually all future growth in phone extensions will come from IP platforms, whether hosted or customer-owned

- Applications expenditures are expected to rise 14% in 2010; they will play a crucial role in increasing an organization's efficiency and employee productivity

- Cisco leads the list of deployed IP PBX vendors by far, with 18% of respondents have Cisco installed today

VOIP AND UNIFIED COMMUNICATION SERVICES MARKET HIGHLIGHTS

- Service provider revenue from residential/SOHO and business VoIP services increased 20% between 2008 and 2009, to $41.6 billion

- IP connectivity services are the fastest growing segment of the business VoIP services market, followed by hosted VoIP and unified communication services and managed IP PBX services

- The sweet spot of the North American IP Centrex services market continues to be small businesses (fewer than 100 employees), although service providers are increasingly signing new customers with more than 100 employees

- Central and Latin America (CALA) saw the strongest revenue growth for VoIP services in 2009, led by the residential VoIP segment, which jumped 84%

- The number of residential/SOHO VoIP subscribers grew 24% in 2009 to 132 million worldwide

- Japan's NTT, Comcast in North America, and France Télécom are the world's largest VoIP service providers, together holding roughly 20% of the world's residential and SOHO VoIP subscribers

4Q09 ENTERPRISE VOIP AND UC EQUIPMENT MARKET HIGHLIGHTS

- In 4Q09, worldwide sales of enterprise unified communication, VoIP, and TDM equipment together grew 3% sequentially, to $2.2 billion

- For the 2009 year, revenue dropped 21%, from $10.4 billion to $8.2 billion

- Revenue is expected to see a lift in 2010, led by pure IP PBX phone systems, as worldwide economic conditions improve

- Cisco continues to lead the pure IP PBX system market, although their annual revenue is down in 2009 from 2008, while NEC and Aastra made big gains in this segment

- Worldwide IP phone shipments continue to recover from their low point in early 2009, up 8% in 4Q09 from 3Q09 and up 7% from 4Q08 (one year prior)

REPORT SYNOPSES

For the Communication Expenditures and IP PBX Vendor Ratings: North American Enterprise Survey, published in March 2010, Infonetics asked IP PBX phone system purchase decision-makers at 113 US and Canadian companies about their 2010-2012 buying plans, the type of equipment being deployed, expenditures, communication infrastructure requirements, and vendors - including vendor brand awareness, vendors installed and under evaluation, vendor familiarity, vendor ratings, and top three IP PBX vendors. Respondents rated 6 IP PBX vendors (Avaya, Cisco, Microsoft, Mitel, NEC, Nortel) on 8 criteria: reliability, security, features, price-to performance ratio, pricing, financial stability, service and support, ease of use.

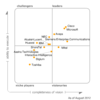

Infonetics' biannual VoIP and UC Services and Subscribers report provides worldwide and regional market size, forecasts, and analysis of residential/SOHO VoIP services, business VoIP and UC services, and residential/SOHO VoIP subscribers. Business voice services tracked include managed IP PBX services, hosted VoIP and unified communication services (IP Centrex by business size, UC applications, UC telephony), and IP connectivity services (VoIP VPN/IP access, SIP trunking, IP integrated access). Consumer VoIP subscriber market share is provided for AT&T, Cablevision, Charter, Comcast, Cox, Embratel NetFone, France Télécom, Free, KDDI, LG Dacom, LibertyGlobal, NTT, ONO, PCCW, Portugal Telecom, Rogers, SFR, SK Broadband, SoftBank, Tele2 Netherlands, Telecom Italia, Time Warner Cable, Vonage, and others. The report includes a VoIP Service Provider Leadership Matrix for North America and EMEA, analyzing and ranking the top IP Centrex and IP connectivity service providers.

Infonetics' quarterly Enterprise Unified Communication, VoIP, and TDM Equipment report tracks 3Com, Aastra, AudioCodes, Alcatel-Lucent, Avaya, Cisco, Dialogic, D-Link, Mitel, NEC, Nortel, NET/Quintum, Samsung, ShoreTel, Siemens, Tadiran, Toshiba, Vertical, and others. The report provides worldwide and regional market size, market share, analysis, and forecasts through 2014 for TDM PBX and KTS systems, hybrid and pure IP PBX systems, IP PBX by system size, VoIP gateways, unified communication applications (communicator, unified messaging), IP desk phones and IP soft phones.