TWC is being bought by Comcast - with Charter taking some pieces of that $45 Billion deal. This would make Comcast - already the biggest ISP and TV provider - even bigger and more powerful. While TWC is not really a competitor to Comcast (in fact, the cable guys collude like no other business sector), it would concentrate a lot of power into one entity that also owns a lot of content under its NBC-Universal.

Before this deal was announced, FCC Chair Wheeler told Softbank that they would not look friendly to a T-Mobile acquisition by Sprint. Post-announcement, it looks like Sprint will make a bid for T-Mobile. I think that deal should be called off. Cellular needs 4 big players - not 3. It would take years for Sprint to integrate and take advantage of this transaction. (Just look at what Sprint did to/with Nextel!)

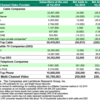

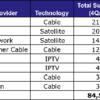

Today, AT&T announced its bid to buy DirecTV for $48 billion. This would all AT&T to combine its 5.7 million U-verse TV customers with DirecTV's 20 million US subscribers - and its 18 million subscribers in Central and South America. AT&T would get a good foothold in Latin America, where most of DTV's growth has been and where it is the biggest pay-TV provider.

In addition, AT&T will benefit from DTV's negotiation power for TV content, including NFL Sunday Ticket. It will have to get big to compete with Comcast (which has a co-marketing deal with Verizon Wireless but not with AT&T).

"The industry needs more competition, not more mergers," said John Bergmayer, senior staff attorney at consumer advocacy group Public Knowledge.

The country also needs less layoffs, which these mergers would definitely result in. The only winners here are shareholders. I don't see any benefit for consumers at all. And it creates even bigger carriers with more power. There's no innovation here either.

"You're talking about a world where two companies control 60 percent or more of the paid-TV and internet market," says Dan Rayburn, an analyst with Frost & Sullivan. "If you thought the net neutrality folks were angry before, this is really gonna set them off."

This also leaves DISH Network still fiddling around with spectrum and stuff.