The CLEC industry has a few problems:

- TDM-to-IP Transition

- USF Reform (E-Rate, ETC)

- Consolidation

- Special Access Pricing

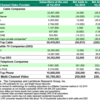

The biggest problem by far is the Comcast-TWC merger. It will replace 2 large MSOs (Comcast + TWC) with 2 much larger service providers (Comcast & Charter). Comcast is already huge - $17B in the last Quarter! Smaller than AT&T's consolidated revenues of $33.0 billion for the quarter ended September 30, 2014. And VZ is at $31.6 billion for total operating revenues in third-quarter 2014. Yet both former RBOCs sell globally and cellular while also offering wireline telecom services.

Comcast is still the largest ISP and the largest TV provider, but only sells business services in about 75% of the USA. That's still a lot of eyeballs.

Comcast formed Business Services in 2006 with its launch of Internet + voice services for small businesses with less than 20 employees, who generated annual revenue of $265 million in its first year! In 2010 Comcast Business Services surpassed $1B in annual revenues. In 2012, 26% of total revenue for Comcast was SMB and 15% of revenue was Metro Ethernet. At about $2 Billion in CLEC revenue, it is larger than most pure CLECs. That size rivals even the ILEC/CLEC's like TDS, Windstream.

Windstream total revenues and sales were $1.46 billion in the third quarter, a decline of 2.9 percent from the same period a year ago. Enterprise and small business service revenues were $752 million. This is smaller than Comcast Business. Do you see why there might be pressure?

At a recent conference, Windstream's CEO said that he was wasn't worried about the cable merger. Really? Cable is beating up DSL and T1; you can win with EoC and fiber. But cable has way more buildings lit -- and way more access to capital for build-outs - - as well as a larger sales force.

"An early business services pioneer, Time Warner Cable's network assets include 58,000 unique fiber lit buildings, 100,000 near net and 860,000 HFC on net buildings to address business customers' needs." [fierce]

Did you read the part that said 15% of Comcast revenue is Metro Ethernet? Do you think they are selling that to small business?

CLECs HAVE to do 4 things:

Positioning - what are they good at delivering and where; Sales Machine - get proficient at selling solutions; UX - large part of the customer (user) experience happens before the first bill - it's call the on-boarding: the provisioning, implementation, training - repeatable processes that focus on the customer experience. Lastly, I would say Culture - if you treat your employees like customers it will show to partners and customers.

Lots of flux in the sector. We'll see what happens.