Opening evening at UBM's BoB Conference was a panel discussion about the change in the VAR and MSP community. This is a collection of tweets about the panel discussion #bob12.

Social Media (SM) , mobility, are cloud - threats to some, opportunities to some - both to many.

"Behave like a three-year old: fall down, learn something, try again."

How do you scale marketing and lower customer acquisition costs in cloud?

The Channel is hiring sales <-- luv to know where they are finding them.

Amazon has $1bill cloud biz and not even 5 people on the street.

Amazon, folks, offers just 2 services in self-serve fashion.

RainKing, Salesforce, radian6 (social media), data mining to understand clients better.

Vendors need scale, but the channel needs customer intimacy (and the channel needs to build its own brand).

Manufacturers do not like the channel. Channel Partners are not enamored with the the manufacturers either.

Biggest Issue: Mainly vendors don't understand what the channel does. Manufacturers/vendors do not like that channel partners are not exclusive and offer choice to the marketplace. [Telecom vendors are the same way!]

@UBMChannel: Number 1 trouble w/ vendors: they don't understand solution provider business and value. "We are not just vehicles to end customers" #BoB12

@UBMChannel: Marketing has changed as businesses do. Moving from finding customers to how do customers find you? #BoB12

Overall, even as the marketplace is changing, manufacturers are slow to change. Vendors still want the channel to just get them customers, push their products and get out of the way. The Channel now wants to build a brand, retain customers, increase wallet share, and sell managed services (some of which will be their own). Unfortunately, there isn't a huge ROI on that strategy for vendors. In Telecom as well.

A final point by the panel revolved around Gartner pushing the Cloud Services Broker model on VAR's. The panel thought that was a ridiculously low margin business - basically, transactional. It is likely going to become what the VAD (value added distributors like Ingram and Tech Data) will become in some sense.

Here's the flipside to that. Right now VAR's have accounts with both Ingram and Tech Data (and likely at least one other distributor like SYNNEX, D&H, CDW, Insight). When looking for hardware, VAR checks to see who has it in stock, at which distribution center, and for how much. When things switch to cloud services, it is unlikely that VAR's will have accounts at all 3 because they are not going to manage SAAS accounts across multiple vendors like they do now. It will be about going with 1 or 2 plus having their own.

The panel noted that we are in the midst of a change in the VAR business to a completely new organization - structure, personnel, skills, compensation, financing, marketing, sales and metrics will all be different when it is all done.

Sales is changing. Not only what is sold, but to who - IT is not the only buyer in an Enterprise any more. IT doesn't own the desktop anymore due to consumerization of IT. CMO and CFO buy differently from CIO. Can IT sales people sell to buyers other than IT?

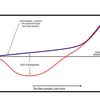

Plus sales isn't about low hanging fruit anymore. It's about harvesting the whole tree. Acquiring customers is getting harder and more expensive. Retaining customers will be huge. Acquiring customers is different now. CLIENTS FIND YOU NOW, via blogs, social media, SEO, PPC. Are you involved in that???

The three panelists are making money now on Help Desk, End user Compute Space (which can include VDI) and in Global Managed Services (including help desk).