If everyone did integration in a similar fashion to the XO-Verizon deal, it would be great. Slow and steady. It isn't a sprint; it is a marathon. No confusion or chaos. The channel folks even seemed happy about it, but that might have been the effects of Stockholm under Icahn.

What happens with Broadview Networks under Windstream? Windstream is only midway through its integration of EarthLink. It will now have 8 UC platforms.

- Broadsoft used for Hospitality and 1M SIP Trunks

- Acquired EarthLink (Metaswitch shop for Virtual & HPBX)

- Allworx (owned by Paetec and forgotten till recently)

- Now the Broadview home brew platform.

- MITEL

- Cisco

- Avaya

- ShoreTel

That isn't too confusing to all of the sales channels. Eight to choose from! WIND should be a one stop shop for everything UC and SIP at this point. [Similar to VARs hitting up a VAD like SYNNEX for many of these same vendors.] To do that, WIND would have to hire in some name brand SIP Experts to start beating that drum - loud, clearly and often. Currently, the message is a new flavor of UC every webinar. No over-arching

The noise about T-Mobile and Sprint merging is getting louder. Here's the problem: Recall the mess that the Nextel-Sprint integration was. This will be worse. Why? T-Mobile didn't even really integrate MetroPCS. What synergies are there really? It would simply be to get bigger, not to be a better competitor. For at least 24 months, VZW and AT&T would simply kick its ass - and they wouldn't be able to do anything about it.

That sums up the Level3-CenturyLink merger as well. That is scheduled to start in September if California and a couple other states don't derail it. This will be a mess for customers and partners alike. The product set is so different. Level3 is wholesale VoIP, international, transit and transport. CenturyLink is consumer, small business, mid-market, broadband, voice and some cloud. Very different sales skills.

Both exited data center, but CenturyLink has acquired many cloud and security companies in the last few years. They haven't done much with it because they don't really sell to Enterprise like they would need to. Plus Branding. Plus confusion over at Savvis after that acquisition.

None of that factors change post merger. None. One problem with many of these telcos is that they don't bring in fresh blood. Frontier just hired from Verizon for VP of sales and retention. Pull in someone from outside telco. The biggest hurdle: Culture. Culture eats Strategy for lunch.

Most of the major CLECs are gone: XO, EarthLink, Level3. Others are transitioning: TPX, AireSpring, Birch, Mettel to try to figure out what business looks like with network resale and managed services. It is a different world.

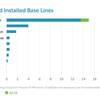

Everyone was betting on UC, but most couldn't get over the deployment headaches. Then when the price war started, they not only weren't prepared for the war, but couldn't or didn't get into it. The latest top 10 leader board for UC doesn't look too much different than 2015 or 2016. Next year it will for certain.

Windstream and Charter should look different in 2018.

Cisco's Spark revamp at EC17 coupled with its latest acquisitions and lay offs might have an effect on Cisco UC seats later this year. Or the acquisition of West Corp by Apollo Management for $5B and change might stall sales. Some of Cisco's other partners - like FLTG in NY - also got acquired. Integration after acquisition always affects sales (and retention).

AT&T and VZ look to be big winners while the CLECs shift and transition. Some of the other players in the space - like Zayo and GTT - also made acquisitions. But are they really replacements for Ma and Pa Bell or even WIndsream, Level3 and C-Link? They have a window of opportunity that is for sure.

Zayo grabbed ELI and Integra. All of the press is about fiber to the tower, so I am thinking that will not be a C-Link or WIND alternative.

Comcast will pick up some business. At $6B in CLEC business revenue now, it almost surpasses most of the CLECs in revenue. They need to take some friction out of the quoting and ordering process. (Charter too! Unbelievable that at its size, it is so arduous to process quotes and orders.)

Until the next merger is announced this is what it will look like. The channel often went to CLECs because of channel friendly attitude as well as suitable product set. This time round the channel will be looking at companies NOT in the midst of turmoil. Ease of doing business will be relative. Just another reason businesses like using channel partners: so they don't have to deal with it!