Apparently, one slightly snarky tweet and a single line item in Tidbits - "A head scratcher: Fonality got bought by Netfortis. Asterisk and Genband." - was annoying to the provider being acquired.

I spoke to five people in the VoIP space familiar with Fonality and none of them had much insight on why this move happened. Well, one answer: scale. Inorganic growth.

At one time, Fonality had a big dealer network with training on the expo hall floors. The HUD (heads up display) was a product spotlight. Voicemail in the cloud was ahead of its time. (I guess you were ahead of Star2Star with the hybrid/premise model.) Then POOF! Fonality wasn't at expos anymore and the noise/attention died down.

Last year Fonality made an exclusive master agent agreement with the Alliance. Hard for that to pay dividends with an industry ARPU of $400 in less than a year. Next thing I know, I get the embargo notice about the merger with Telekenex aka Netfortris.

I'm not a fan of embargo news because it always slips out (like this did). The merger news made Facebook just after I agreed to the embargo. After it hits the social networks, it isn't worth writing much about - unless it is big. I told the PR firm it was only going to be a line item and a tweet. And apparently that was upsetting to Fonality. So they replied via the PR firm.

Marty Williams, head of product marketing for Fonality, wrote via a PR firm: "While Fonality does provide premise PBX solutions for customers who want it, the bulk of our business is cloud telephony and UCaaS. Fonality's top-rated UCaaS platform and its telephony management network are internally developed. Owning this intellectual property and the opportunity to expand IP development for the future is critical to leading the evolution of state-of-the-art, secure cloud communication and network services that increases productivity for our valued customers."

Fonality was founded in 2004 and grabbed "$50.4M in 6 Rounds from 6 Investors". It looks like they were at $45M in revenue in 2015. Fonality has over 200 employees. The deal was probably worth right around $100M because hardware revenue is worth less than recurring service revenue. It also begs the question how did Netfortris finance it?

Yeah, I am a skeptic. If this IP was award winning and awesome, why didn't you knock it out of the park? You were ahead of the pack a couple of times. Did you get tired? Discouraged? It sounds like money men wanted to cash out. (Nothing wrong with that.)

Again, yeah, I am a skeptic. The VoIP industry is more than 15 years old and is still just a dial-tone replacement. Billions in investment in this industry and it takes non-VoIP companies to do interesting things with it (thanks to the technology of WebRTC).

Even Microsoft has done more in the UC space in a short time with Skype4B than most providers have done with their product bundle in ten years.

There are over two thousand me-too companies offering up pretty much the same Hosted PBX service. RingCentral wrote, "The promise of UCC needs to go beyond multi-modal communications in one place. Rather, it should be about what the cloud can do to transform the way people work. I've said before , that it's about unified experiences, not just unified communications. Our vision of this is coming to fruition by combining best-in-class UCaaS, team messaging and collaboration, video and web conferencing, cloud contact center--all served on an open platform, at global scale."

There is a distinct difference between selling basic voice service and selling UC. When selling UC, you are selling CHANGE. And selling Change is F***ing HARD. People hate Change.

But for a business to improve in productivity and efficiency, they have to do things differently; they have to Change some habits. They need to leverage the technology that our industry has made available to any business anywhere and any time. That is the Magic the cloud is offering. It isn't about the cheapest seat price to get the deal. That's dial-tone.

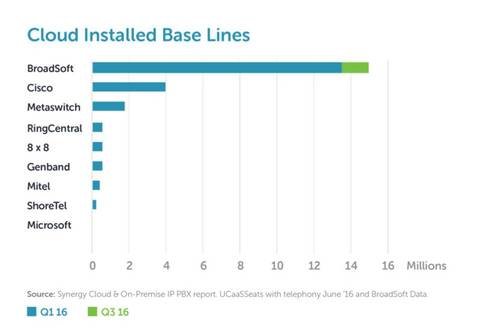

Look at that chart above. No one is crushing it. How many Cisco partners are there*? How many Microsoft partners? (They are doing better than shown here.) Metaswitch has over 700 customers. Broadsoft has over 400. Why hasn't the pie been eaten yet?

Despite the Avaya bankruptcy, premise PBX sales have only dropped roughly 3% per year. That isn't a whole lot of rip and replace with cloud comms!! It's kind of embarrassing.

In the Tidbits article, I mentioned that the most interesting move I saw was Atlassian buying task management provider, Trello. Now you have Project Management with collab and chat via Hipchat (like Slack). Voice and video calling can be done via WebRTC. Even screen sharing. All that is needed is a Dropbox. That kind of bundle is more interesting to me. Consolidating 2 of the 2000+ just isn't interesting to me. I understand that scale is important; and consolidation in this space is needed, but that doesn't make it interesting - to me.

SIDE NOTE:

In 2014 there were 70 Silver and 20 Gold and 2000 partners at the Cisco event that year. No clear total number. Microsoft's online directory lists over 30K partners.