One thing I have noticed: UCaaS sales overall are not accelerating. Gary Kim writes how it is becoming a commodity.

The VoIP services market is up 5% to $73Bn in 2015, says IHS. Residential makes up 62% of that. UCaaS grew just 6%.

Meanwhile, 8x8 grew 29% YoY for 2 years. ARPU is $369.

Vonage Business grew because of acquisitions. It is yet to be seen how the 4 acquisitions, 3 platforms and large target market work together. From selling to very small business (VSB) with a sub-$200 ARPU to acquiring a company with $4400 ARPU is a wide range. Three of the acquisitions were all about Hosted PBX, but iCore, founded in 2004, was offering their 85K seats Microsoft SfB, IAAS and Broadsoft.

The sales avenues are different too. Telesphere and Simple Signal drove sales primarily through the indirect Channel. That is different than Vocalocity and Vonage, which were focused on inside sales and online sales to generate business. iCore was all direct sales. A lot of different engines. Channel Conflict abounds.

Most startup success, according to Bill Gross, is about Timing. Broadsoft had a long run- 12 years or so - of having to compete against just premise PBX and open source Hosted PBX offerings. Broadsoft and its client providers had ten-plus years to ramp up the market and create demand.

Unfortunately that wasnot enough time to make the market move to where they needed it to go. Selling Change is very hard. Most people buy replacement products. Telecom is a toothache that they don't want to deal with. They stick to what they know.

Salespeople - indirect and direct sales channels - have spent years selling replacement services in a transactional manner. Getting those channels to shift to selling change (cloud) has been slow and is still in-process.

There isn't enough Demand yet. There isn't a Brand driving the market.

Seth Godin writes about Awareness, trust and action. While the awareness for UCaaS may be increasing, the action piece hasn't. Probably because of the Trust piece. And actual awareness of UC, HPBX, UCaaS, CCaaS, ECaaS and other meaningless terms bantered about by the providers probably causes more confusion than awareness. Confusion does not foster Trust. See the dilemma?

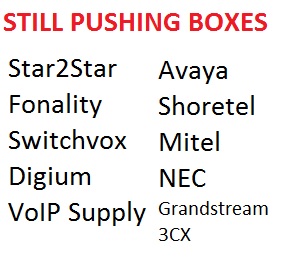

Hardware PBX is still selling. Now it sits in a data center instead of on-premise (within easy reach), but still selling. Ask any of these companies if boxes are still moving:

People are staying safe. The Trust Thing Again.

Microsoft and Cisco have what I call Demand. People want to buy it. They distribute through VADs quite frankly because they don't want to deal with distribution to what amounted to 125K resellers in years past. Far easier to let a VAD like Ingram handle it.

Today, we see ITSPs knocking on the door of VADs hoping that it will increase sales. I don't see how that model works, since the ITSP has yet to create DEMAND or Awareness for its BRAND.

A VAD is an online catalog of SKUs. It is not something that you can browse. You have to know what you are looking for. Even searching for a category like a UPS or a switch needs to be narrowed down to size or brand or model. So searching for something that doesn't even lend itself to SKU would be irksome. (Irksome doesn't work. Frictionless works.)

While it, a VoIP SKU, is a billable entity, it has to be consumable like a software license or a piece of hardware. And the reseller has to understand the SKU and how it fits into the solution (what other SKUs are needed to build the solution.) It is more complex than I can describe until you have searched for a SPLA from Microsoft for your specific use case. Now imagine scrolling through that to order a UCaaS solution for a company of 20 employees plus porting numbers and toll-free. Yeah.

[Another visual on this concept, remember how many USOC codes were needed to create a PRI? It was the channel, the PRI card, the loop, and the DID. VoIP is similar. So what SKUs will you need for a seat, a voicemail, an efax, etc.?]

That doesn't even consider how a reseller would know to order your stuff through Ingram - and why he would do that as opposed to going to a master agency or going direct.

Demand and Brand are just 2 key components. Timing, which is required for startups, is starting to slip away. Microsoft and Cisco and other entrenched vendors are tying up the Enterprise space. Lots of room to sell to under 100 seats - a majority of the market - but no one wants the hassle. Cost of sale is high. Cost of support is high. Churn is high. No upside, except that market size they keep quoting in investor prezos consists of mainly the sub 100 seat company. It should be interesting.