Alcatel-Lucent’s Rich Crowe opens a new chapter of the Six Degrees of Mobile Data Plan Innovation blog series by examining consumer interest in shared data plans.

Shared data plans have become popular with mobile operators. Today, 19 of the world’s 25 largest mobile operators by subscriber base size[1] offer data-sharing options. Many others are following suit and offering subscribers the ability to connect several users or devices to the same pool of mobile data.

For operators, the addition of shared data plans is about clearing new paths to market expansion, subscriber stickiness and bottom-line growth. But what do mobile consumers think of shared data? What factors make them more or less likely to embrace it? And what impact does it have on whether they stick with a mobile operator?

|

“Multi-device Shared Plans are starting to gain traction in the market as they now represent 8.3% of tariff plans, growing 38% QoQ.” |

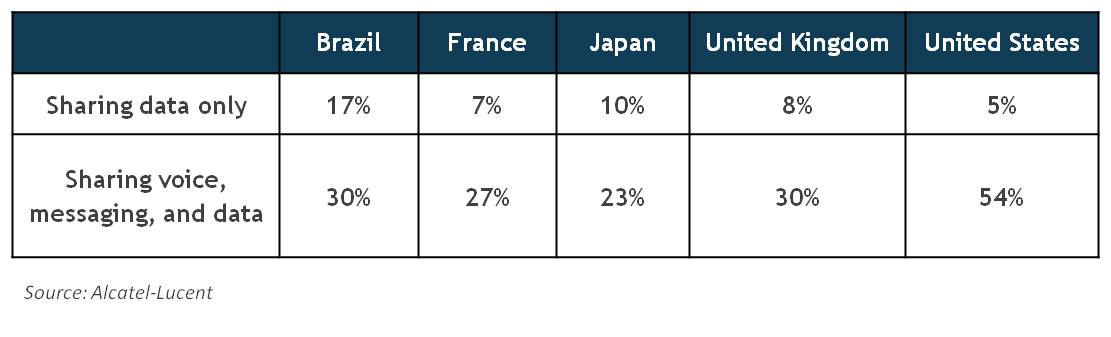

The survey results highlight shared data’s potential to attract and retain subscribers. All surveyed countries display significant interest in data sharing, as illustrated in Table 1. Interest in data sharing is greatest in the United States (59%) and Brazil (47%). Respondents consistently show more interest in sharing voice, messaging and data across multiple users and connected devices than in sharing data only. Interest in voice-messaging-data sharing is greatest in the US (54%), Brazil (30%) and the United Kingdom (30%).

It’s not surprising to find a high level of interest in shared data plans among US consumers. Major US operators are leading the push for shared data plans, and Verizon Wireless launched its Share Everything plan nearly 2 years ago.

But shared data doesn’t just appeal to US mobile consumers. A sizable segment of the market in all of the surveyed countries is interested in sharing data. More importantly for mobile operators, this segment is willing to act to get its data plan of choice.

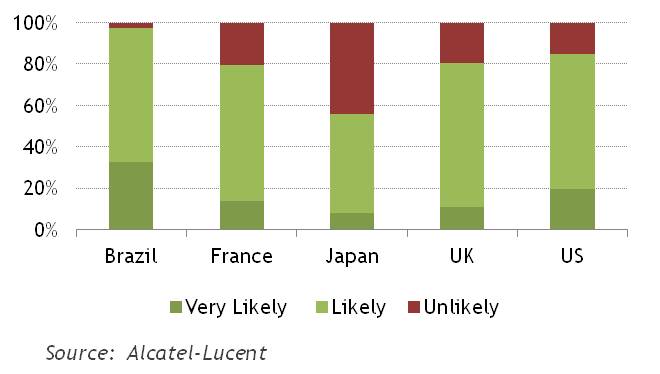

For example, respondents who express an interest in a shared data plan are highly likely to purchase one (Figure 1). In Brazil, 97% of these respondents say they are likely or very likely to buy a shared data plan. Likelihood to purchase is also high among interested respondents in the US (85%), UK (80%) and France (80%).

Respondents in Japan are the least inclined take the shared data plunge. Even so, 56% of those interested in sharing data say they would likely or very likely purchase a shared data plan. The very high probability of purchase in Brazil could be influenced by the fact that the survey reached a larger-than-average percentage of households with either 3 or more members (69%) or 3 or more devices (78%).

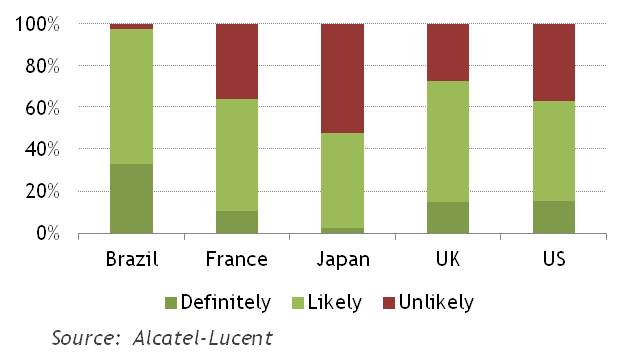

Those interested in sharing data are also willing to switch mobile operators to get this capability. Respondents in Brazil show the strongest willingness to change operators, with 97% of those interested in shared data indicating that they would definitely or likely make a switch to get a shared data plan. Interested respondents in the UK are also very open to change: 73% would change operators to get shared data. Figure 2 breaks down the churn impact of shared data plans across the 5 surveyed countries.

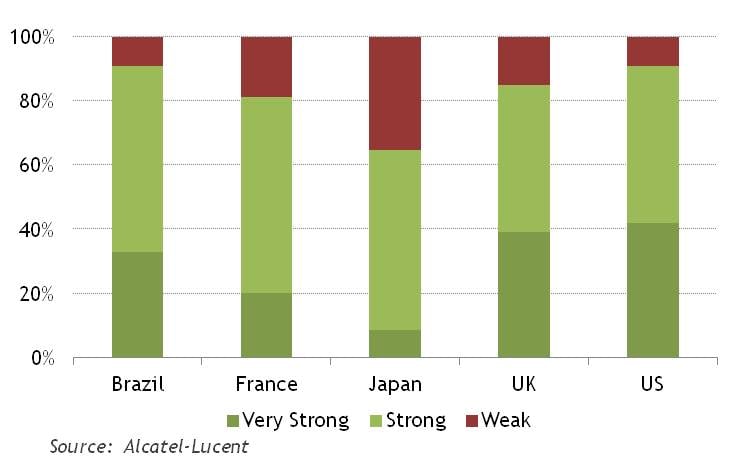

Shared data plans can play a strong role in subscriber retention, too. Results from all countries indicate that those interested in shared data are willing to stay with their current operator to keep it. The retention impact is highest in the US and Brazil, where 91% of those interested in shared data say that it plays a strong or very strong role in keeping them on board. Japanese consumers are less likely to stay with their current operators to keep shared data, but its retention impact (65% strong or very strong) is still formidable. Figure 3 summarizes the retention impact of shared data plans across the 5 surveyed countries.

What do all these interest, purchase likelihood, churn and retention numbers tell us? That this segment of the market knows what it wants and is willing to take action to get it!

And what’s behind the numbers? Respondents cite anticipated cost savings and efficient use of data across mobile devices as their major reasons for favoring share plans. Many also see shared data plans as a means to minimize “slippage” – data that is paid for each month but that goes unused. Those not interested in shared data plans primarily want to keep an existing unlimited data plan or have few mobile devices or users with which to share the data. They also anticipate that shared data plans will come with a cost increase.

Respondents interested in data sharing generally have a higher monthly mobile spend and a larger data allowance. Those who have purchased a Wi-Fi tethering plan from their mobile operator are also favorably inclined toward shared data plans. Finally, the number of people and mobile devices in the household influences interest in and willingness to adopt shared data plans. A minimum of 3 people or devices is the threshold at which consumers become interested in sharing data.

The Alcatel-Lucent research confirms that there is broad consumer interest in shared data plans. It also confirms that those interested in shared data are likely to take action to get it. Shared data is a tool that every mobile network can use to attract and retain customers.

Connect with the author, Rich Crowe, on Twitter: @rhcrowe.

Download the Six Degrees of Mobile Data Plan Innovation e-book. Please follow us on TMCnet, and click here to subscribe for more information and updates.

Past blogs in this series:

- Mobile Data Plans: The Options for Aligning Services with Consumer Needs

- Bringing customers closer: Six degrees of mobile data plan innovation

- Six Degrees of Mobile Data Plan Innovation: Service Level-based Plans

- Six Degrees of Mobile Data Plan Innovation: Shared Data Plans

- Six Degrees of Mobile Data Plan Innovation: Application-Based Plans

- Six Degrees of Mobile Data Plan Innovation: Third Party Pays

- Six Degrees of Mobile Data Plan Innovation: Loyalty-Based Plans

- Six Degrees of Mobile Data Plan Innovation: Capacity-Based Plans

- Coming Soon To A Mobile Operator Near You: The Six Degrees Of Mobile Data Plan Innovation

[1] Subscriber base size from “Service Provider Capex, Opex, Revenue, and Subscribers Database Quarterly Worldwide and Regional Database.” Infonetics Research, updated April 7, 2014.