CenturyLink Biz has an ebook out with predictions for 2013 and beyond. M2M, mobility, cloud - all just mind blowing stuff

Well, the FCC's pace for any case is slow and slower, so they will likely not get to the copper clipping and IP transition until 3Q2013 at the earliest. meanwhile, CLEC's have to be vigilante to document cases of copper clipping, because all the money that they - Integra, Megapath, TelePacific, XO, Windstream - have invested in EoC doesn't work without said copper. I think they will be fine until 2014 on this.

That said, CLEC's have to accelerate their plans for OTT services like cloud and Managed IT. When the copper plant disappears, wholesale (from fiber providers and cablecos) will get expensive. The money will be in Layer 7. I have often said that it was going to be Layer 1 or Layer 7. Without a network that you own, it will be a fight for apps and services. Everything will look like Office 365 - where 42,000 Microsoft partners are selling it for very little margin.

Here's the thing: more businesses are moving to the cloud for so many reasons - mobility just being one of them. Some CLEC's, VARs and even Agents will migrate to a cloud services brokerage model. That will work for slinging Hosted Exchange, SharePoint, CRM, simple backup, even VPS. Network will become a separate sale and negotiation.

I'm still shocked that no one has rolled out vertically based integrated bundles yet.

So mobility will still be huge in 2013, but with the new shared data plans, the monthly bill will be increasing, so businesses (and consumers) will be looking for alternatives. Wi-fi will be significant. When you add in mobile data caps and consumer cable caps - and metering - there will be a net effect on cloud services and OTT services.

When you examine the backlash yesterday on the Instagram privacy gaff (right after Facebook finished acquiring them for $715M), you have to wonder how much longer the online phenomenon continues. Privacy is non-existent. You have to be off-the-grid and paying with cash to be beyond corporate and government spying. I think we will see a little more backlash in 2013 - enough that FB and other companies see a dip in usage and corresponding advertising sales. Have FB and twitter peaked?

The companies to watch in 2013:

- RIM and Alcatel because they are re-inventing;

- Avaya because of its crushing debt;

- Bright House due to its Telovations acquisition and to see if it is the first cableco to chase business outside of its region;

- 8x8 and similar OTT Hosted PBX players like FreedomIQ;

- the Cloud Communications Alliance, especially the members who have not been acquired yet. If Hosted PBX doesn't explode in 2013, it never will;

- Sprint because Clearwire+DISH+Softbank = a big ugly mess with Hesse;

- Verizon but specifically its OTT hosted PBX service, VCE;

- Dell as it continues its shift to cloud services from hardware;

- Tech Data - between TDmobility and the Microcorp deal - 2013 will be telling;

- AirWatch since MDM is huge and they are being sued;

- Master Agencies that have to figure out relevancy in 2013.

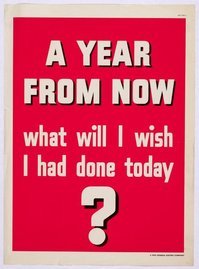

For Agents and VARs, 2013 is the year they have to put a plan together. No more waiting. Too many VAR's are already jumping on the telecom/network bandwagon and not nearly enough Agents are jumping into the Managed Services and Cloud space. For Agents, 2 resolutions for 2013 would be (1) partner with a VAR or two; and (2) cross-sell services to grab more of the total wallet share of your customers. Look to revenue per customer and lifetime value of each customer as the most important metrics. (Mainly because they are.)

For VAR's, they have seen some big changes from Microsoft - Small Business Server's end of life as well as the way Office 365 was sold. VAR's also witnessed CLEC's - like Cbeyond and EarthLink - make a big splash in launching managed services and cloud offerings. In 2013, VARs will need network/telecom to make up for the revenue dips. Locally in Tampa, we have seen some Microsoft partners go to programming and integration services in place of the old model of SBS and Exchange. For all of cloud adoption, Integration is the key to any business process outcomes. There aren't nearly enough programmers to do all the necessary integration.

In the Google world, there are companies making money supporting and integrating Google Apps. Backupify, Batchbook, Insightly are just 3 companies that integrate with Google Apps for CRM and backup. As this ecosystem becomes more complete, Microcorp's deal with NeoNova could prove brilliant.

It is this type of package or bundle that most businesses want. Do they want stand-alone Hosted Exchange? Notsomuch. They want a complete package of inter-working software - the Hosted PBX integrated with Outlook and the browser - like they have on their smartphone!! It confuses me that the smartphone is more integrated than a laptop, Mac or desktop.

They want their CRM to integrate with all of it too. If Xobni can pull in all that social data, why can't a plug-in for CRM?

It's this complete solution that is needed. No idea what company will roll it out first or if it will be in 2013.