I have a lot of snippets on the UCAAS and UC&C space to share, in no certain order.

We have seen consolidation in the contact center space - ININ-Genesys and others. It isn't over yet. There are too many players in the marketplace, and for right this moment money is still cheap. Better to buy your competition than try to beat them.

More predictions: "Global unified communication and collaboration market expected to grow at a CAGR of 12.3% from 2016-2020," says a report by Technavio.

So 8x8 and Vonage are at 600K seats each. 8x8 has 45,000 Customers according to June 2016 investor prezo with ARPU at $399 now.

Windstream and BroadSoft team up to bring customized Virtual PBX to hospitality market. WIND is a confusing deal. They own Allworx which they never discuss. They push MITEL and Avaya - and they have a Broadsoft. That is a lot of platforms to know, sell, manage, support.

Comcast Business Services revenue increased 17.0% to $1.4Bn with small business accounting for ~75% of revenue and ~60% of growth. Voice makes up 7% of Biz Services Rev..

Megapath launched the latest Broadsoft offering called MegaPath One with the usual collection of bells and whistles. MegaPath also rolled out Skype for Biz integration.

ITSPs are so worried about Microsoft eating their lunch that they integrate with it or add some Microsoft to their offering, like MegaPath and Velis4. Even TelePacific is joining the Microsoft CSP program. WIth the DSCI deal approved at the federal level, there should be more news out of TelePacific.

RingCentral doesn't break any stats out anymore as they just play with GAAP and performa stylized finance sheets. "In 2015, nearly 30% of RNG Office new bookings coming from up-market customers with at least 50 users, up from about 20% in the year ago period." Now they are bringing in customers with 100+ seats. All the UCaaS players are going upmarket, where the ARPU is higher, to cover the cost of sales and support.

RingCentral (RC) did make one big change: previously RC distributed phones to customers by reselling third-party phones; maintaining inventory, handling A/R and warranty processing, etc. Now they made a deal with Westcon to distribute phones to RC customers with RC acting as an Agent of Westcon and getting a referral payment per order. Westcon will now maintain inventory, handle A/R and warranty processing.

Jabra Survey Finds Small/Medium Businesses Driving Productivity through Unified Communications. "Between a third and two-thirds of all small/medium businesses (SME) will either add unified communications (UC) or replace existing systems with UC within the two years, according to a recent survey by Jabra."

Cisco Spark, Microsoft Skype4B and other services are putting pressure on the OTT VoIP players. "RingCentral and friends are now facing challenges from Microsoft and many other titan-sized technology experts. The proof is in the pudding, and these VoIP experts must continue to show that they can deliver healthy business results in head-to-head competition with true giants," states this article. Because all the noise right now is about Skype (and Slack started doing TV commercials), the market is wondering if stand-alone VoIP can continue to afford to buy market share. VoIP players are giving free phones, SPIFFs, free months of service, just to get a customer. The cost of that acquisition is being questioned on the stock market. OR it may all be a fluke and stock speculation going awry.

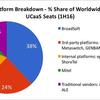

There were a large number of service providers in the space of UC&C - from Fuze, RC, the Cloud Comm Alliance members to the LECs to the other numerous ITSPs. Then softswitch vendors decided to become service providers, too. Broadsoft BroadCloud; GenBand Nuvia; Alianza Cloud Voice Platform; and Metaswitch MetaSphere Cloud Services are all competing with their customers and making it easier for new entrants into the already bloody ocean of Hosted VoIP. (Now even enterprises can be an ITSP).

Everyone is pushing up-market, but Cisco recently did a study on small businesses. The study found "on the IT front, a majority of small companies (86 percent) are considering the use of cloud-based unified communications (UC) systems as a possible solution to their communications needs, replacing their more traditional premises-based counterparts."

"Yet unified communications as a packaged service, despite its relative maturity, remains far less than universally adopted, particularly outside of larger enterprise accounts. A recent survey of more than 400 enterprise and SMB IT decision-makers, performed by UBM Tech for XO Communications, found that only one-third of organizations had fully embraced UC. On the other side of the spectrum, a separate survey performed by Osterman Research for ConnectSolutions found that about as many IT decision-makers (26 percent) and business deci-sion makers (39 percent) are either "somewhat" or "very fearful" of migrating to UC. Nearly half of those surveyed admitted that they don't fully understand the full impact UC would have on their organizations. These fears and trepidations come despite the fact that 71 percent of those surveyed by Osterman believe there are "significant" or even "enormous" benefits that can be realized from the deployment of UC." [from ChannelVision magazine].

Mobile UC is going to be another segment of the UCaaS pie. Mast Mobile, Apple, Google and now Verizon's One Talk. You know that Sprint could have driven this years ago when it first announced integration into the Broadsoft switch for 4-digit dialing to cellphones. But Sprint just couldn't get out of their own way. It would take months to deal with them for quotes, sales sheets, etc. It would be scary to think how long deployment would take. But now VZW is doing it - all in-house - with their Broadsoft.