The rumor on Friday turned out to be true: CenturyLink is buying Level3. CenturyLink has its roots in the RLEC business. It has acquired a number of smaller RLECs throughout the years including VZ and GTE assets. In 2002, it started making mistakes when it sold its cellular business to ALLTEL. It acquired Digital Teleport and renamed it LightCore. Every year it has acquired some assets, mainly smaller RLEC companies and the accompanying POTS lines.

In 2008, C-Link bought Embarq, formerly Sprint/United.in $11.6B deal including assumed debt. In 2010, C-Link bought Qwest which included RBOC assets that flew the US West banner. "The valuation of CenturyLink's purchase was $22.4 billion, including the assumption of $11.8 billion of outstanding debt held by Qwest."

In 2011, CenturyLink begins to stray from grabbing fiber and POTS lines in favor of the data center business it acquired with Qwest. Much to the chagrin of the agent channel, Savvis was scooped up for $3.2B including debt. This started a series of acquisitions to beef up a cloud business that for all intents and purposes C-Link is mired in for no reason.

The ITO Business Division of Ciber (managed services), AppFrog (PAAS), Tier3 (IAAS), Cognilytics (analytics), DataGardens (DRaaS), Orchestrate (DBaaS), netAura LLC (security services) and ElasticBox (VPS) - all scooped up in the last 3 years to make a soup out of a cloud division that it is still trying to sell. The rumor today is that Savvis will be spun off. No word if that will be just data center or both data center and cloud. And that makes even less sense since Level3 actually knows how to sell colocation - unlike practically anyone in Monroe.

I understand that being rural and watching your CAF and USF subsidies slowly decrease makes you yearn for fatter and happier days. And when you look at Level3's $10B in NOLs, you start to think like Carl Icahn. However, have you seen what Icahn did to XO???? Have you seen what C-Link did to Qwest and Savvis??? That husk will next be Level3.

With debt this deal will be worth about $34B to get combined revenues to $25B.

Not a single merger in telecom in the last fifteen years resulted in anything good. Not one.

The integrations rarely go as planned. These two companies probably have 26 or more separate and different software systems in the BSS/OSS. These will NEVER be integrated. Orders, status and asset availability will be a nightmare. I know. I know. You think I am a pessimist. But truly this will suck especially for the channel.

Any agent that says this is good is either (a) looking for press or (b) is delusional.

There is now less choice. When VZ takes over XO, except for Zayo, who is left that isn't a LEC or cableco? What happened to the CLEC industry? Totally collapsed as its owners cashed out. Everyone got bigger and no one got better. One by one they have fallen.

It is why Cable is winning the broadband game. (Cable is single minded.) It is why businesses buy cloud services from OTT. (Bell-head mentality precludes anything but network and voice.)

This is the LEC problem: lack of focus; deficient long term strategy; and a missing willingness to win the customer. It's all about the creation of value without actually creating any value.

Since the Board will almost stay intact and the CEO remains, what new gen strategy or thinking do you think will occur with the combined entity? I get why the L3 CFO is staying: someone has to keep that debt at bay and play with the NOLs so that the stock doesn't crash when revenues start to slide.

I won't even get into the culture differences between the 2 companies. L3 and TWT had only slightly different cultures but most of the TWT people exited. This is a good payday for L3 CEO but he will go down as the guy who killed a good idea. The blood of thousands of employees and agents are on Story's head.

Hopefully, someone else will make a BID for Level3 as a white knight - Comcast, Zayo, or a PE firm*.

**Although STT owns about 13% of Level3, I don't see a PE firm wanting the company, except to do to it what Icahn did to XO. L3 doesn't throw off enough cash.

According to CenturyLink press release, the deal, which is expected to close by the end of the 3Q 2017, results in:

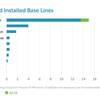

- 200,000 route miles of fiber, which includes 64,000 route miles in 350 metropolitan areas and 33,000 subsea route miles connecting multiple continents

- CenturyLink's on-net buildings are expected to increase by nearly 75 percent to approximately 75,000, including 10,000 buildings in EMEA and Latin America