Sonus bought Taqua for about $20 million. Taqua builds a Class 4/5 voice switch that has been around a long while with 400 customers globally (a little less than BSFT). "Total revenue was $28.3 million and $25.2 million for the fiscal years ended December 31, 2015 and 2014, respectively. Total revenue was $16.8 million for the trailing twelve months ended June 30, 2016." Taqua had pivoted to Voice over Wireless recently. Sonus is notable for its SBC. No idea how this mash-up plays out. Customer consolidation is one squeeze, but the other squeeze comes from all vendors now offer a wide portfolio - SBC, eSBC, switches, SDN, NFV, blah blah blah. Makes it tough in a me-too market with buyers who are either too busy or stuck in a purchasing maze.

In the world of Anti-Virus, two Czech companies are merging. Avast made a $1.3B offer for all the public shares of AVG.

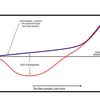

Jon Arnold has a nice write up from MoNage - Messaging on the Net - about messaging and comms. Interesting stats. It explains the Slack phenomenon.

From 451 Research Group, Colocation vs. Cloud: "Many providers claim that SMBs are skipping colocation and going straight to the cloud. However, 451 Research studies show that this isn't so black and white. In the 'S' portion of the SMB market (<249 employees), companies are more likely to have some sort of cloud-based service (IaaS, SaaS, PaaS or hosted private cloud) than colocation services, but only by a margin of about 19 percentage points (49% to 30%). In the 'M' segment of the SMB market (250-999 employees), the numbers are about even between cloud and colocation services (38.2% to 38.9%, respectively)."