With all of the deals going on being a telecom partner is a nervous business. Why do I say that? Uncertainty is never good. Less choice is never good. Less competition is unhealthy for an industry.

AT&T with its DirecTV buy and its grab for TW is basically following Comcast's playbook. Comcast bought NBCU, is becoming an MVNO (cellular reseller) and has a $6B Comcast Business division that is going to chase enterprise (much to the dismay of CenturyLink and Windstream).

Verizon is busy selling off wireline assets and buying up as much spectrum as its AMEX card will allow in a heavy bet that 5G and IOT will solve all of their revenue and cable issues. In a move bizarre move, VZ bought up AOL and Yahoo as content plays. This playbook is solely Lowell C. McAdam's.

Frontier, Fairpoint, CenturyLink and Windstream are RLECs looking to get out from under a heavy debt burden without cellular assets and without a content play. Each has its own playbook.

Windstream buying EarthLink almost makes sense especially at a $1.1 Billion all stock deal. (This move doesn't hurt the channel since both providers were pro-channel.)

CenturyLink buying Level3 is not only surprising; it is disheartening. Level3 has its problems certainly. Yet its management understood the business it was in and what it took to win business. For a partner, that is a plus.

To fuel that $34B deal (total value of stock, debt, etc), CenturyLink is selling its data center business (Qwest and Savvis) for $2.1B to a coalition of PE firms headed by the former CEO of Terremark. This coalition is also buying 4 cyber-security firms to build a global cyber security business. Partners are curious if they will still get paid on deals already sold. And what the future holds here.

FPL getting acquired by Crown Castle also makes partners worry about commissions, since CC doesn't have a channel and doesn't retail its fiber.

The CLEC industry is practically gone now. After nearly one trillion in investment money dating back to 1996 or so, most of the CLECs we have come to know and sell are pretty much gone.

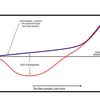

What does that leave the Channel? IOT, Cloud, UCaaS, SD-WAN, security - basically selling managed services. Network is going to be tough to sell and make a living on as prices continue to erode. SD-WAN for the win!!!

Network is easy to sell and there is demand for it. You really can't say that for any other product in the portfolio.

Data center is still alive and well. Long live colocation!