On a LinkedIn blog, Telarus co-founder Patrick Oborn writes about the fact that 72% of businesses have not transitioned to cloud communications. 72%!!!

After 15 years, 2000+ providers can only take a 28% handhold in the market?

The growth rate of Hosted PBX (HPBX/UC/UCaaS) has always been a hopeful bad guess. And it will continue to do so because too many people, companies and dollars have been invested thus far for any analyst to turn on the sector.

There are 4 major problems with the UC Market.

One, PBX sales have declined about 3% per year. Even Avaya going bankrupt isn't going to speed that up. Not only do people trust boxes; they are cheaper in the long run. Single location businesses, which is most of them, don't have a PBX problem that UC solves. There is a current Product/Market MisMatch that needs to be examined.

Mobile UC may get more traction. Or a simple PBX like Dialpad or Fone.do. Gary Kim writes that the market may be too small. At ARPU of $400, it takes a bunch of sales to move a needle for a company like CenturyLink, Verizon, AT&T, Comcast or Charter.

Two, I wrote this last week. Any 15 year old product needs a re-fresh or re-think. We are overdue for a Re-Think. Slack was a re-think, but that strays to the edges of what UC is. So does Cloud Contact Center. And these companies want to be everything for 1-1000 employees. This isn't Pasta or Rice. This is technology.

UC is Change. People hate change. The Channel doesn't sell Change; we take orders on replacement services. Harsh but mainly true. There are exceptions of course, but the general rule is that agents are transactional. Even Inter-Connects aren't excited to go sell a cloud service. MSPs will if it is white-label and can be bundled into their package, but that falls into POTS Replacement more than a full-blown UC deployment.

Three, HPBX has 2 camps of buyers: POTS replacement sold as cheap as possible and actual UCaaS. Where do you think most of the market is? Right, cheap VoIP.

Now if I am buying cheap VoIP, am I also going to pay for a backup circuit or SD-WAN or any other service enhancement or assurance? Unlikely -- or I wouldn't be buying cheap cable broadband and the cheapest OTT voice!!!

If the buyer spends more on bandwidth, has a backup circuit, they are likely going to buy UC as BC/DR and that isn't cheap VoIP.

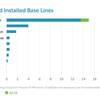

The fourth Big Problem: There are far too many providers! Telarus represents at least 37 HPBX vendors. Other masters have at least 25. How does anyone differentiate/ stand out/ position in a marketplace where the cloud broker has a choice of 2000+ providers?

This becomes a problem for the providers who enter into a Price War (seats cratering to below $15 each) and a SPIFF War, where providers are literally buying sales.

One of the most successful HPBX providers, 8x8, is up for sale. This move comes after a recent re-branding as a Global UCaaS provider.

Are the owners (the 8x8 founders still own most of the voting stock) looking to exit? Or is it that the machine to keep bringing in 20% growth quarter after quarter is grinding down? I just don't know who would pay $1.5 Billion for 8x8. VZ payed $1.8 for XO which owned fiber assets. WIND payed $1.1B in an all stock deal for EarthLink, who also had a bunch of fiber. Fiber gets a bigger multiple than VoIP.

The other thought is that what if $300M is about all the B2B annual revenue you can get?

From a recent discussion about Amazon Chime: there are approximately 100 million phone/conferencing lines in North America. If Amazon Chime with Vonage can hit a 5% share of this market, that equates to 5 million subs. At $5/seat/month, that is $300M incremental revenue opportunity for Vonage. That would be a needle mover for most UC Provider, considering 8x8 is at $225M in annual revenue now.

The emphasis has always been on multi-location and mid-market. That's why "41% of larger enterprises are using cloud UC services." Now everyone is focused there (upmarket). However, the bulk of the businesses are single location small business (20 million of them). That means a new product bundle is needed to attract this crowd. Many thing that this sector will be mobile only with an auto-attendant in the cloud.

When you look at the large number of messaging apps, at some point, one of them - Slack, Messenger, WeChat, HipChat - will hit the right bundle of functions to steal mass appeal. Not yet, but maybe soon.