The SD-WAN market is still doing amazingly well – based on customer wins and funding. We just reported Bigleaf Networks got $21M in funding, 128 Technology got $30M and Aryaka

$50M.

Why?

This important segment of the enterprise networking market will grow at a 30.8% compound annual growth rate (CAGR) from 2018 to 2023 to reach $5.25B, according to IDC’s SD-WAN Infrastructure Forecast.

“SD-WAN continues to be one of the fastest-growing segments of the network infrastructure market, driven by a variety of factors. First, traditional enterprise WANs are increasingly not meeting the needs of today’s modern digital businesses, especially as it relates to supporting SaaS apps and multi- and hybrid-cloud usage. Second, enterprises are interested in easier management of multiple connection types across their WAN to improve application performance and end-user experience,” said Rohit Mehra, vice president, Network Infrastructure. “Combined with the rapid embrace of SD-WAN by leading communications service providers globally, these trends continue to drive deployments of SD-WAN, providing enterprises with dynamic management of hybrid WAN connections and the ability to guarantee high levels of quality of service on a per-application basis.”

The SD-WAN infrastructure market continues to be highly competitive with sales increasing 64.9% in 2018 to $1.37 billion. Incumbent networking vendors have leveraged their technological strengths and installed bases in routing and WAN optimization sales to lead the market, while numerous start-ups remain active.

The latest IDC market share report ranks Cisco in first place for 2018 market share worldwide for SD-WAN Infrastructure, which was up 64.0 percent last year. Cisco, according to the report, captured 46.4 percent of the total SD-WAN market last year or $637.7M, an increase of 55.4 percent year-over-year.

Trailing Cisco was the “rest of market” segment, which included a mix of emerging SD-WAN players such as CloudGenix, Fortinet, and Versa Networks. The “rest of market” segment captured 20.8 percent of the SD-WAN market in 2018 or $285.9M, up 86.1 percent year-over-year.

The rapid growth in the market fueled by cybersecurity, business continuity and the move to cloud and DX. Finally, MPLS arbitrage doesn’t hurt.

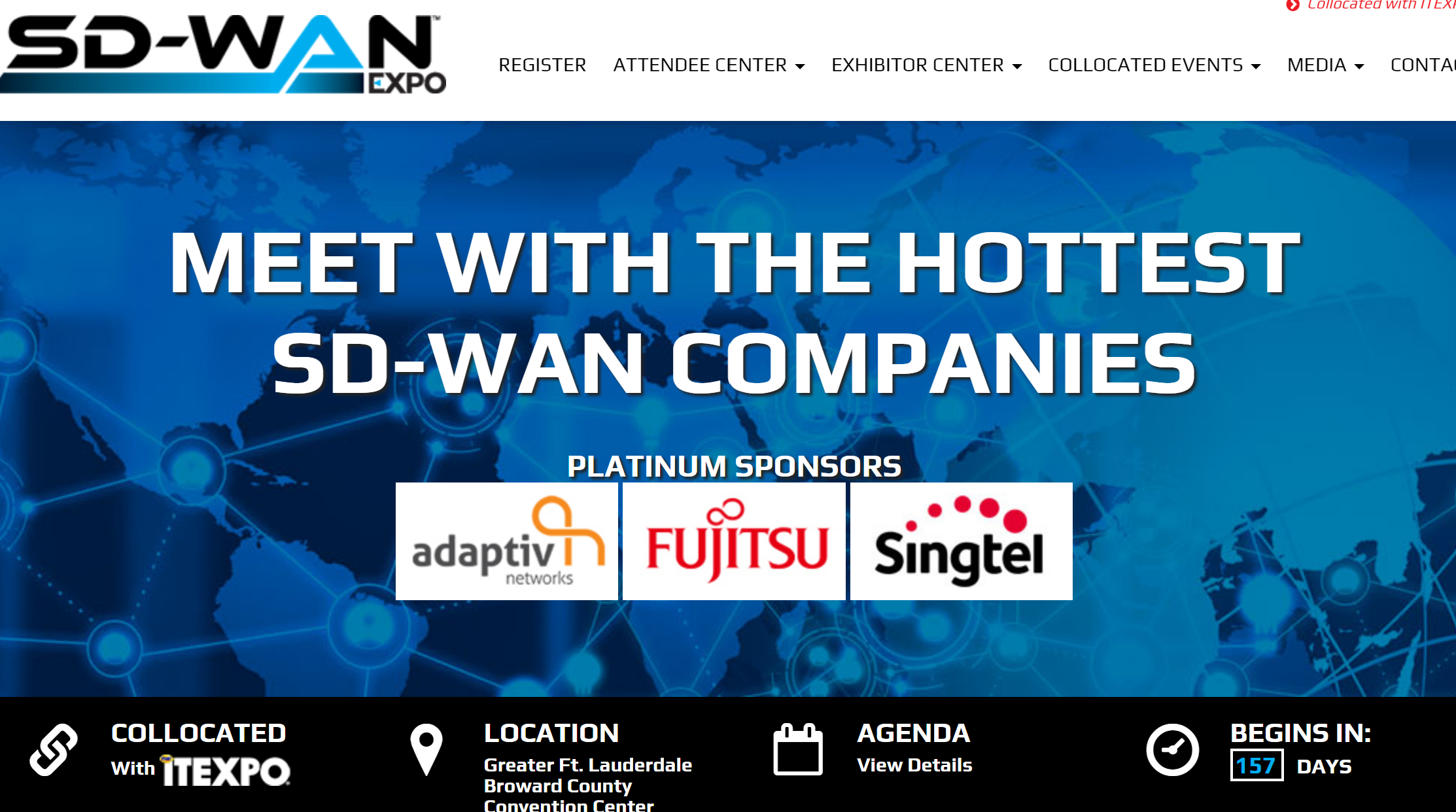

It’s an exciting time for customers looking for SD-WAN solutions and digital transformation tools in general. Companies should come and learn about the latest in everything you need! SIP Trunking, UCaaS, the Channel, IT, IOT, Edge, Cybersecurity, AI, SD-WAN, and the Future of Work at the world’s only SD-WAN Expo and MSP Expo, part of the ITEXPO #TechSuperShow, Feb 12-14, 2020 Fort Lauderdale, FL.

You will see all the leaders in SD-WAN, including (so far):

- Telarus

- Aryaka

- Singtel

- HughesON

- Adaptiv Networks

- Fujitsu

- Oracle

- Tallac