Recently, we have received numerous questions about the private market investment environment due to rising interest rates, inflation concerns, the Ukraine war and increased stock market volatility. Here is a summary of recent news mixed with our experiences over the last few months which hopefully provides some insight into what’s happening.

Some companies are dealing with the current challenges head on. According to Pitchbook, Instacart acted on its own initiative to cut its valuation1 to $24 billion, a markdown of almost 40% which speaks to the problems companies face on recruitment and retention if employee stock is priced too high because it limits their upside potential.

We continue to see high valuations in the crypto2 and cybersecurity3 space while fintech, AI and metaverse also remain hot. Some analysists believe4, an obsession with the metaverse will spur further blockchain investment. Numerous VCs have told us they are focused on climate and carbon removal/ESG startups.

Foodtech remains very hot. Fake meat and dairy Startups accounted for5 almost half of the $12.8B invested in this area last year.

A common theme from many VCs we’ve spoken with in the last few months is they are looking for 150%-200% or more growth from series A SaaS companies. A significant number have also mentioned the need for SaaS ARR near or at $5 million6.

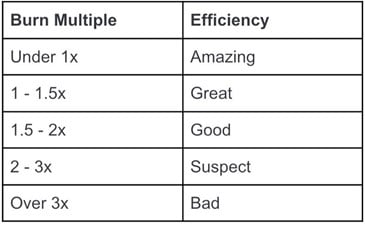

VCs have internal metrics to determine if they want to consider a potential investment. Customer acquisition cost (CAC), net revenue retention (NRR) and customer lifetime value (CLV) are common ones. One which is less known that we really like is from investor David Sacks and is called the Burn Multiple.

Burn Multiple = Net Burn / Net New ARR This is his “Rule of thumb:”

The idea here is VCs using this or a similar formula will determine the product-market fit based on how much money is needed to increase ARR. Sacks says, “In a tough fundraising environment, it won’t just be growth but the efficiency of growth that are seen as the key indicators of startup performance. Tracking the Burn Multiple is an easy way for founders to make sure that burn isn’t getting ahead of traction. Over time, it also reveals important information about whether incremental spend is working.”

A recent transaction which caught our eye is Theta Lake which offers a security and compliance solution for popular collaboration applications closing a $50 million series B funding round7. They have about 64 employees and are valued at $250 million. Battery Ventures led the round, while collaboration platform vendors that participated were Cisco Investments, RingCentral Ventures, Zoom and Salesforce Ventures (Slack is owned by Salesforce). Other backers in the round were Neotribe Ventures and Lightspeed Venture Partners. The company has now raised $71 million in funding since its launch in 2017. We do not have any information regarding the company’s sales.

Y Combinator is a solid barometer to watch when it comes to funding. They just announced their winter batch of 414 funded companies8 in the following sectors:

- B2B/Enterprise – 34%

- Fintech (including consumer fintech) – 24%

- Consumer (including consumer healthcare) – 13%

- DevTools – 7%

- Bio/Healthcare (Diagnostics/Therapeutics/Med Device) – 11%

- Education – 2%

- Climate/Energy/Sustainability – 4%

- Proptech – 4%

- Aerospace – 1%

Based on the top two sectors, it seems they believe business productivity tools have a strong future and that current banking models can be vastly improved upon.

Bloomberg News had a good interview9 with who we believe to be one of the smartest and most successful investors around… Sequoia Capital Managing Partner, Doug Leone where he said, “Venture capital funds have gone from telling portfolio companies “run, run, run” to “stop, stop, stop.” He continued, “With prices sticking downwards, there are fewer investors and fewer founders as [is] typical in a down-market cycle.”

Despite the recent downturn, Sequoia has led a $60 million funding round in Cyera, an Israeli cyber security startup that helps companies such as Takeda Pharmaceutical Co. protect their data stored in cloud servers. Other investors include Accel and Cyberstarts. Leone joined Cyera’s board and expects to remain there for at least a decade, he said.

“Security is going to continue to be a market opportunity for the next 30 years,” Leone said. “A lot of companies don’t even know what data they have or where it’s located. And then they have to secure it.”

We want to leave this post on a high note. Congrats to Katie Haun who just raised the largest debut fund ever by a female VC10 and possibly, any VC… She raised $1.5 billion. “It feels, honestly, like a lot of pressure. But I think that motivates everyone on the team,” Haun says. “Web3 is the new era of the internet and it deserves a new era of investors.”

In summary, there has been a significant volatility in public markets which naturally leads to fear in private markets. Still, for some high-growth companies and those in select sectors, the pain is currently not as bad as the broader market – at this time.

Aside from his role as CEO of TMC and chairman of ITEXPO, Rich Tehrani is CEO of RT Advisors and a Registered Representative with and offering securities through Four Points Capital Partners LLC (Four Points) (Member FINRA/SIPC). RT Advisors is not owned by Four Points.

RT-Advisors continues its mission of assisting tech

companies in M&A and capital raising using our unique tech media background

and relationships to aid companies to optimally position themselves. In

addition, as of late we have been increasingly assisting fast-growing tech

companies in obtaining non-dilutive capital. Please let us know

if we can be of assistance.

The

above is not a recommendation to buy/sell any security or sector mentioned.

If you no longer want to

receive very occasional correspondence from RT Advisors about what is happening

in M&A and funding, please reply unsubscribe in the subject or body.

- Pitchbook

- Bloomberg: Blockchain.com Raises New Funding at $14 Billion Valuation

- Reuters: Cybersecurity startup Axonius valued at $2.6 bln after latest funding

- Pitchbook Emerging Tech Research, Vertical Snapshot, Blockchain 2022

- Crunchbase News: Faux Meat And Dairy Startups Consume Nearly Half Of Record $13B VC Investment Into Foodtech

- Based on RT Advisors discussions with numerous global VCs between November 2021-March 2022

- VentureBeat

- Y Combinator’s 34th Demo Day: Meet the YC Winter 2022 Batch

- Bloomberg

- CNBC: Crypto investor Katie Haun raises $1.5 billion, the largest debut fund ever by a female VC