This past June we gave our opinion on why the Intel-Apple split is a disaster for Intel. That post focused primarily on the desktop – arguing that the computing power of Apple desktop systems will soon be so much greater than those based on Intel that PCs will lose share. We didn’t mention that Windows machine makers will need to adopt ARM architectures as well to stay competitive but that will happen.

This leads us to the data center which we touched on when we wrote about Nuvia and their initial funding in November of last year.

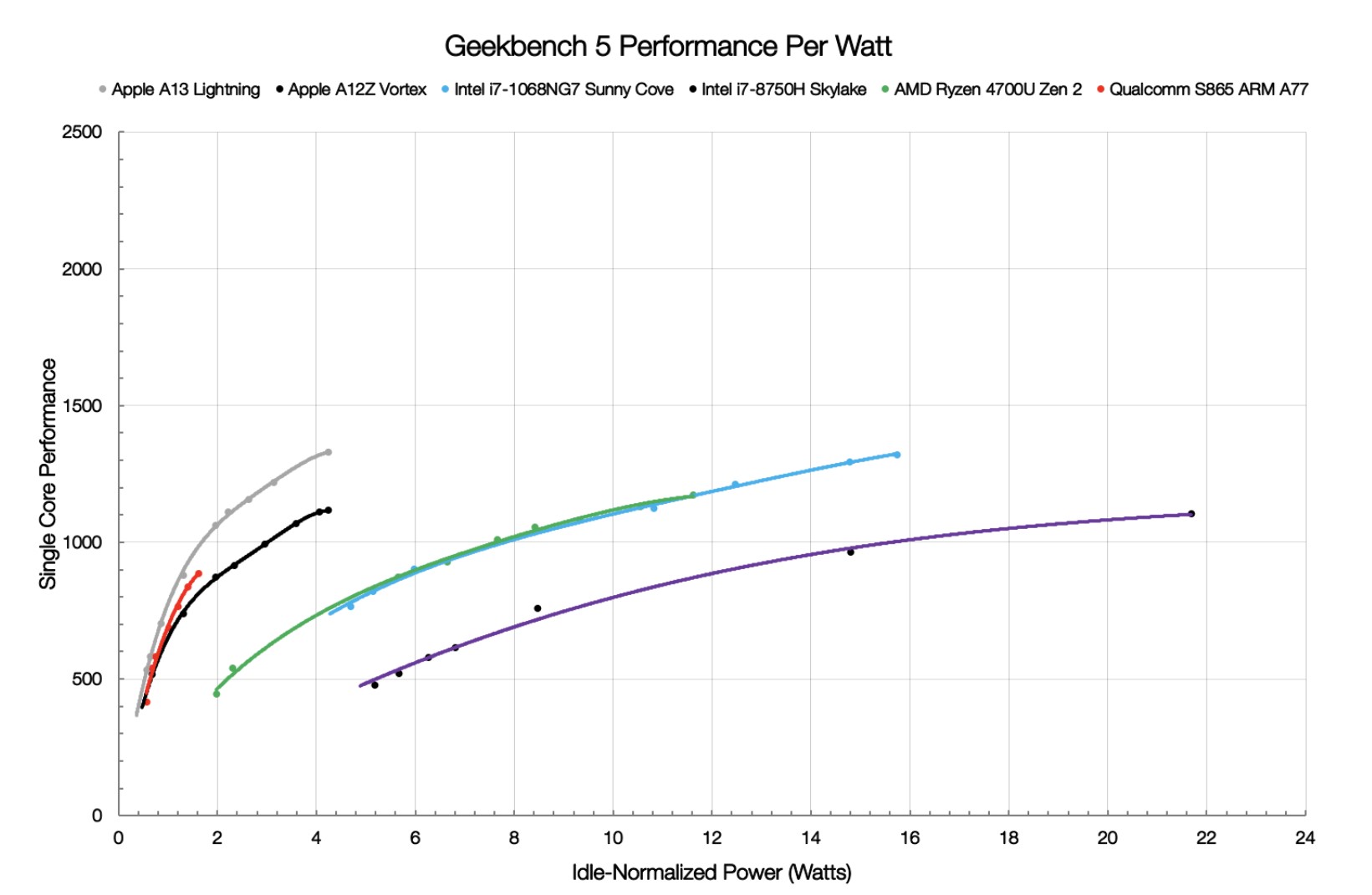

What Apple and others have shown possible is the power per watt of computing of the ARM design is superior to Intel-based on reduced instruction sets versus more complex instruction sets.

Classic disruption theory says the more inexpensive, mass-produced product will often evolve to the point where it takes out the more specialized high-end competitor.

The hard disk market is the classic case – where RAID technology allowed smaller, lower-capacity, cheaper disks to take out the more specialized large disk competitors.

Nuvia just raised $240 million dollars and this shift is the reason…

They believe and obviously, their investors agree that the data center will be a winner-take-all area thanks to the history of the market and our shared experience of looking at the search market, e-commerce and others where a single vendor dominates.

What Nuvia has done is take the people with chip design experience at Apple, Google and others and have them apply similar principles of maximizing power per watt in the data center.

Two trends make the company unstoppable if no other serious competitor emerges. Let’s leave NVIDIA out of the discussion for this post.

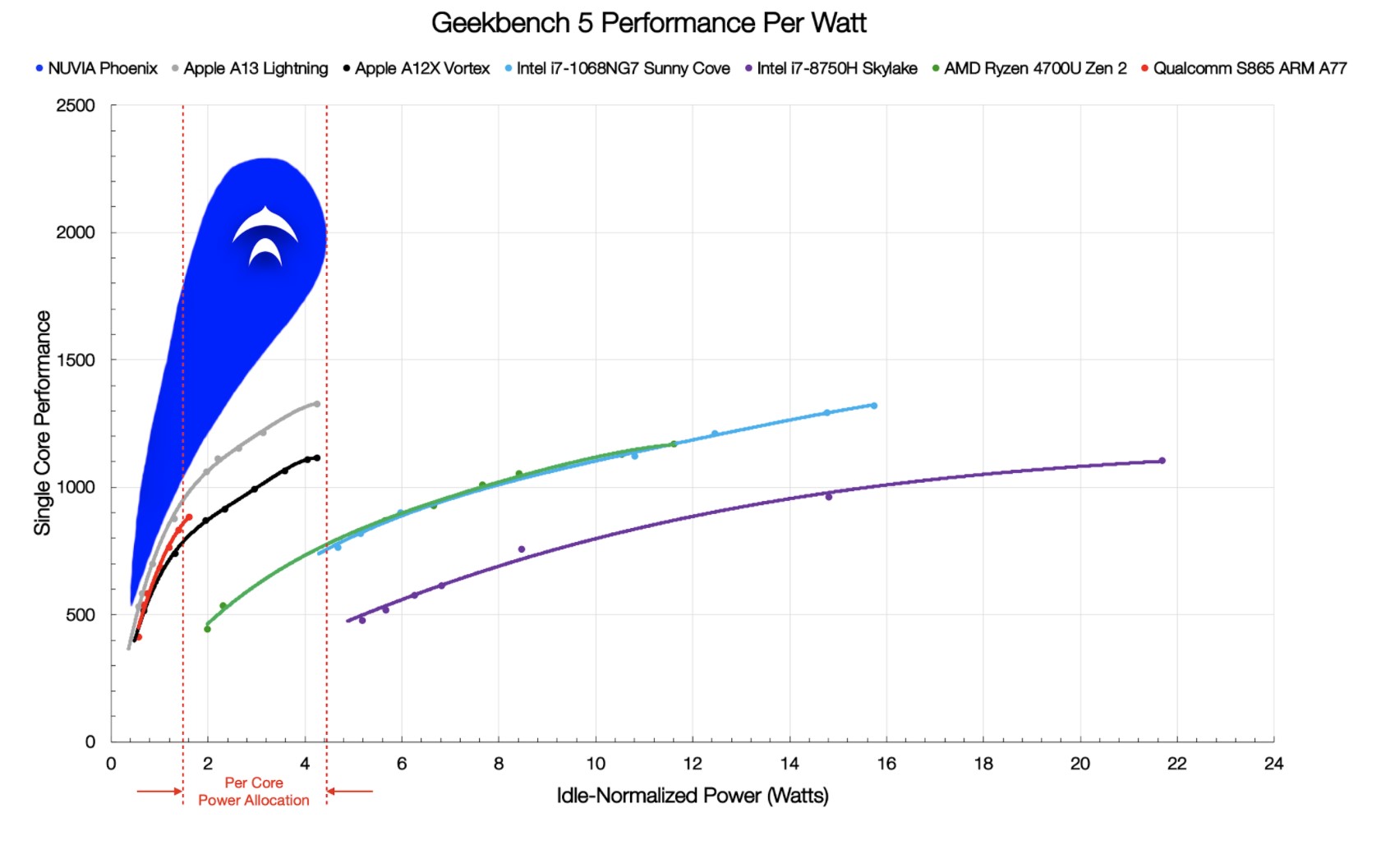

Hyperscale data center growth is astronomical and they have serious heat dissipation and power constraints. The former is often the bigger issue. According to Nuvia, the maximum power a CPU can be allocated is between 1W-4.5W in such a center. They believe the NUVIA Phoenix CPU core has the potential to reset the bar for the market.

As they make their case, they show what Apple has done – see the grey line to the left. The performance Cupertino achieves at 4W is similar to what an Intel Core i7 does at 16W.

Their specialized chip will have twice the performance of its competitors – based on modeling techniques they employ. They are being a bit coy right now about the details but that makes sense because they likely don’t want to be wrong about the end-result of what their chip will be able to accomplish when it is released in 2022.

The server chip market is obviously huge – around $10 billion today and greater than $15 billion by 2025. If there is one winner or even a major player, this is a tremendous return on investment for the investors.

Of course, we know with so much at stake, Intel itself is going to ensure they don’t lose their lead, doing everything they can. The company has had some stumbles lately but decades of success tell us we shouldn’t count them out. In addition, there are a lot of talented ARM chip designers out there who could start a competitor and existing companies with ARM chip designers in-house who are paying close attention to what is happening here.

The good news is that the industry is working towards maximizing the power per watt of a hyperscale data center. This in turn means the data center becomes more efficient. In this case – using today’s numbers of the performance of current CPUs compared to Nuvia’s projections, a hyperscale data center will be able to increase its total compute power by 8x without increasing its heat generation. This is a huge jump for the industry if their estimates are accurate.

See the ONLY networking, UCaaS, SD-WAN and Tech companies that matter at the ITEXPO #TECHSUPERSHOW.

This Event has been called the BEST SHOW in 5 YEARS and the Best TECHNOLOGY EVENT of 2020.

2020 participants included: Amazon, Cisco, Google, IBM, ClearlyIP, Avaya, Vonage, 8×8, Comcast Business, BlueJeans, CoreDial, Dell, Edify, Epygi, FreeSWITCH, Fuze, Grandstream, Granite, Intrado, Frontier Business, Fujitsu, Jenne, West, Konftel, Intelisys, Martello, NetSapiens, OOMA, Oracle, OpenVox, Peerless Network, Phone Sentry, Phone.com, Poly, QuestBlue, RingByName, Sangoma, SingTel, SkySwitch, Spracht, Spectrum, Sprint, Tallac, Tech Data, Telarus, TCG, Teledynamics, Teli, Telinta, Telispire, Telstra, TransNexus, Unified Office, Vital PBX, VoIP Supply, Voxbone, VoIP.MS, Windstream, XCALY, XORCOM, Yealink, Yubox, and ZYCOO. Full List.

Join 8K others with $25B+ in IT buying power who plan 2021 budgets! Including 3,500+ resellers!

A unique experience with a collocated Future of Work Expo, SD-WAN Expo, and MSP Expo…

New Dates! June 22-25, 2021, Miami, FL. Register now.