How Bitcoin and the Free Market can Screw up Bitcoin and the Free Market

The beauty of cryptocurrencies and ICOs is there now a way for tech to take on governments and allow consumers access to an alternative to government controlled “money.” Bitcoins and related currencies are a libertarian dream – allowing people from repressed countries such as Argentina, China and others to take their money out of these financial prisons if they so choose.

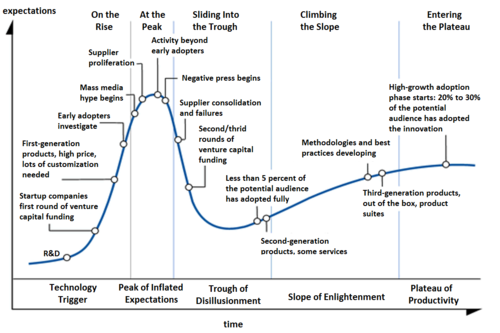

In 2013 we detailed the 15 reasons bitcoins were better than gold, we then reiterated it is Gold 2.0. In January of this year we charted Bitcoin according to the Tech Hype Cycle and predicted the price would break out based upon how technology adoption works. Both charts are posted below for your convenience. We were the only entity to make this correlation.

Hype Cycle

Bitcoin pricing

We were spot on – the value of bitcoin has almost risen by 5x since this prediction, valued as of this writing at $4702.73 dollars.

Now however complaints are mounting from would-be Bitcoin buyers. One of the companies which is at the center of the issue is Coinbase who according to our sources will gladly accept wire transfers of money which don’t subsequently show up in a person’s account. At least not quickly.

Here are the exact comments from one investor:

- No customer service.

- No live support.

- Slow as $h)t response from “support bots”

- Need to get humans to respond.

- Ignore multiple emails and support requests.

- Message boards say this is just how they work.

Could the problem be a lack of staff, lack of resources, etc? It would seem to make sense. But there is no real way to contact the company to find out what is happening. We tweeted them, we called them (415-275-2890) and reached out to CEO Brian David Armstrong on LinkedIn and did not hear back immediately – we will update this post if we do.

The problem in short is as follows:

According to the Consumer Financial Protection Bureau or CFPB, in 2017, there were 288 complaints against Coinbase, up from a total of six complaints in 2016. Coinbase is expected to receive 442 complaints in 2017, up from 6 complaints in 2016.

Based on our research the number will likely even higher than this.

At this rate, the market will receive so much negative attention that US regulators will feel like they need to step in. The entire point of blockchain-powered Bitcoin and other cryptocurrencies is the lack of government involvement.

But, if we don’t get this cleaned up fast, we risk killing the goose that lays the golden cryptocurrency. Remember that back in 2013 the CME was able to instantly kill the silver market, the same thing can happen to the cryptocurrency space.

If any of our readers know any Coinbase employees or Brian David Armstrong, please have them reach out to me ASAP to get this problem squared away before one CEO and his employees tarnish an entire industry and the dreams of libertarians and people everywhere who need to be able to access their money, anywhere they wish and want an investment which is not dependent upon central banks acting responsibly.

We hope to see you soon at THE Blockchain Event, where we’ll get to experience growth of Blockchain, Bitcoin and FinTech together. Register now to save up to $400.

-thumb-500x214-15913.png)