Acme Packet is hosting their Acme Packet University at Harvard University in Cambridge. I spoke with the company’s Co-Founder, CEO & President Andy Ory before the session kicked off and the topic of Sonus came up. The two companies partnered for many years and eventually Sonus reached out to Acme to purchase them however Acme had begun the filing to go public and Sonus had taken a hit to their market cap so the deal never happened.

According to Andy, the idea today is to explain to the world how complicated the SBC space is – one part switch, security device and softswitch. These are separate disciplines in most companies – making it more complicated to build a good SBC.

He then briefly outlined the future and what we will learn today – how hosted-IMS based solutions will help move the industry forward.

9:00 Session kicks off

Marianne Budnick, CMO kicked things off and set the tone for the day.

Patrick MeLampy Co-Founder and CTO began with a history of the

markets and Acme.

Net2Phone NetMeeting had problems – in part because they wouldn’t work through NAT and this derailed the company.

The company started in Andy’s house and the workers were day trading as well as working – this was 2000 after all.

Lots of talk of the alphabet soup of standards IP communications had to deal with until around the time of 9/11.

The partnership with Sonus Networks helped them a great deal back in the day.

People like Henry Sinnreich and Jonathon Rosenberg “hated” Acme because they didn’t want the carriers to be able to control the endpoints. They were fans of a more democratized approach.

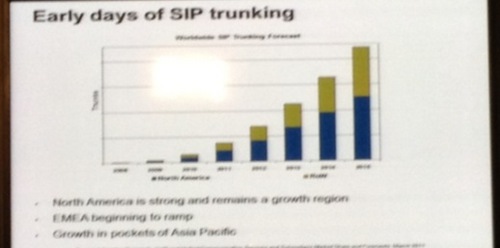

SIP trunking has a way to go and is driving our business forward.

Other opportunities: More and more CODECS, more transcoding, more operating systems, hypervisors, lawful intercept points, etc.

Patrick explains how SBCs work – as if they were transactions in a bank.

“I wish SIP were simple like IP.” There are 215 RFCs, 80 Internet drafts in last 12 months alone.

The reason things are so complicated is because of vested interests and that is the way things work today. In other words, the traffic from your 4G cell phone shouldn’t need to travel back to the US when you are in Europe but that is what is happening because that is how it works today.

4G phones use a different CODEC than 3G phones – transcoding gateways are cheaper to buy than adding both CODECs to 4G phones in-part because licensing prices from Qualcomm are high. These gateways make carrier networks far more complicated.

Doing nothing not an option for carriers – voice is declining in revenue while complexity is increasing. Acme is not just protecting and securing. They went from securing to allowing interoperability as SIP versions proliferated. In the future they see their role as allowing simpler deployment of voice and thereby allowing incumbents to compete with services like Google Voice.

The future is about deploying SBC and related infrastructure in the cloud in an elastic manner. The evolved packet core needs to be another access network – the role needs to be redefined.

Load balancing is important – they sell a load balancer. The important issue is he orchestration of the service across these computers. Session management in call recording and monitoring is very very important.

Andy: The complexity is increasing – we have hired 200 people in the last 18-20 months to deal with this complexity. It is very hard for people for legacy companies to deal with this problem. In a statement of potential risk for the company he said, “The challenge is things get so complex that we can’t deal with the complexity either.” He continued, “We don’t think this will happen – this is all we are focused on.”

Dan Warren Sr. Technologist with GSMA takes stage to discuss IMS implementation in the cloud.

It is tough for carriers to compete with startups – on the Internet – many companies have to die for a few to be successful. The internet has more scale and is faster – operators also can’t work together because of antitrust concerns.

What operators do well is provide full connectivity – you can call anywhere in the world with 10 digits. They do standards well also – they make ecosystems work without suppressing innovation – lots of different types of phones, etc.

SS7 networks were based on trust – but in IP world “Everyone thinks everyone else is trying to screw them” this is why we need security. My thoughts are that IP is open and more accessible to hacking – you would need a class 4 or 5 switch to hack into the SS7 network and these things would take an entire floor of a building – even if you could afford it, you couldn’t run and hide with it if the cops came.

RCS is an ecosystem allowing you to have seamless messaging – started 7 years ago to compete with Skype. IMS is complex and expensive and RCS does things that Skype and Facebook does for free so business model doesnt make sense. Now, carriers have to utilize IMS because they need a viable voice service over LTE so RCS does begin to make sense.

VoLTE will be essential for 4G carriers and these network deployments will all require SBCs – in-depth discussion of how much potential there will be for Acme and SBC space in general as LTE gets rolled out. One limiting factor is VoLTE handsets which have good battery life. Then there was a chicken and egg discussion about making sure networks re ready for the handsets before the handsets become available.

11:45 am

Kevin Klett VP Product Management:

Discussion of various standards and signaling protocols – how important user experience is. Is network available – not just jitter and latency. Also a discussion of regulatory agencies and the fact that incumbent carriers have to deal with this challenge while new entrants do not.

You must control the signaling and bearer plane to ensure a secure network – to make sure you can ensure who gets on the network.

wi

Huge myth that internal threats aren’t a problem – in other words you can’t necessarily trust authenticated devices. Security is about keeping the network up and running. There can be damage to brand, legal implications, loss of revenue and SLAs issues. Also have to be able to keep subscribers anonymous. Signaling contains a good deal of information.

There are 6-7 variations of lawful intercept.

Contact centers are another large area of growth for the company. Traditional and IP based contact centers.

There haven’t been large-scale IMS networks rolled out to date. 130+ projects in 55 countries have been deployed. The company interops wit

h 8+ major IMS vendors.

Ron Gruia with Frost & Sullivan asks: Can you scale signaling and media independently

Andy said: Carriers want to know if you can you ride Moore’s law.

Carriers wasn’t to be able to decrease and increase capacity as needed. They do not want to buy all new hardware. We have worked on optimizing our solutions to run on VMWare and Zen.

We aren’t dogmatic – we can do this on purpose built or custom hardware. We think this will happen – all different ways.

There is variable pricing in such a scenario where you can purchase service as needed as well as “keep in reserve” pricing for more bursty traffic.

We can disrupt our own business model – this is an advantage for us and disadvantage for the incumbent IMS providers.

This statement was in reference to the fact that the company can provide hosted services without concern regarding killing off the switching side of the house, etc. This would be a concern of larger competitors who sell more integrated solutions which are soup to nuts solutions. (On a separate note shouldn’t this be soup to crackers? Why nuts?)

12:45 lunch

Andy takes the podium at lunch – he discussed how partnering in the early days with large NEMs was important to their success. This is a bit funny because I tend to agree with Andy – at least that is the sense of the market. Patrick said earlier today that technology decisions are why Acme prevailed. This reminds me of the story (excuse my paraphrasing from memory) where a bunch of people with blindfolds go into a room and try to figure out what the object in the room is – its an elephant. One person grabbed a leg and proclaimed it was a tree while another grabbed the trunk and said it was a snake. The moral – your point of view is shaped by you perspective.

Important points

- Unified Service: anytime, anywhere. Like accessing Gmail anywhere.

- Customers have relationships with more service providers – this will only increase.

- Cloud can be centralized and dynamic around the edges

- Thinks communications for SMBs will clearly move to cloud.

- More federated communications will take place – like Facebook working with mobile carriers, etc. Customers may purchase OTT services but purchase quality of service and better quality connectivity from a carrier.

- Slide of new devices from past 3 weeks – 8 in total see photo below.

- IP = identity and privacy. We don’t trust an email from the bank asking for a user name and password but we do trust the phone. As we move to IP – someone has to enable this trusted environment. All these choices require more remediation and control.

- In IP we don’t trust anyone.

- addresses and identities are heterogeneous and will continue to be

- CODECS are breeding like rabbits – Microsoft seems to be creating them at will – then went through scores of codecs from different markets, companies and standards bodies.

Discussion – what happens if there are less CODECS due to standards bodies simplifying things. Andy says no as codecs introduce complexity and degrade quality.

- No matter how much bandwidth you give someone – they will find a way to overdrive it. LTE will not solve the bandwidth problem. There will continue to be more tiers, WiFi offload, small cells, etc. LTE is overburdened in theory before it is even deployed.

- Some sessions more important than others. Sessions which have been paid for or are reserved – are more important.

- Network/sessions needs control and manageability.

- Primary lines will always have regulatory compliance E-911 and lawful intercept.

- Business models will be heterogeneous – some will provide pipes others will build brands and create services. Others will partner with companies and sell access to their service infrastructure – A carrier can provide regulatory compliance – ensure calls are connected properly, etc.

- IP networks will be service-enabled and must provide normalized communications.

- The company is beginning to transition from an SBC company to on which provides session delivery networking. (This is in line with the company’s marketing at MWC 2012 in Barcelona).

- Video is the same as voice from a session delivery perspective.

- One interesting point is that as sessions hop onto untrusted networks like WiFi at Starbucks – you will need SBCs to deal with the connections to keep them trusted. Reminder about how carriers are moving to WiFI offload – see my recent article on Taqua from MWC 2012.

1:40 pm

VoIP service revenue continues to grow. Some carriers – one in China are transitioning to VoIP to save money on power consumed by their legacy equipment.

Discussion of all the vendors in the market from Sons, Radisys, GENBAND, Metaswitch, Broadsoft, AudioCdes, etc.

Discussion of an IMS chart – she mentioned how difficult it is to monitor the market because the items on an IMS chart represent elements not necessarily SKUs or boxes.

SK Telecom has been very innovative in IMS, providing video, messaging, whiteboarding and more – you must check them out – they are doing IMS over wireless.

Significant grilling of analyst about a chart she showed with SBC growth continuing at a compound rate through 2016.

Others in the room said no carrier spending chart ever looks like this – going up every year.

Anther person in the room chimed in explaining that the dips in the market are impossible to predict in advance.

Diane explained how there is also a major move to the cloud by all carriers – this may have caused them to slow down decision-making in general as they determine where to spend, how much and where.

Moreover, carrier are trying to figure out where to spend as subscriber habits are changing – they may use less or more voice in the future. Carriers need to spend accordingly.

2:20 pm

Diagram with clouds – a SIP trunking discussion.

Segue into Enterprise from Carrier market

At end of 2010, under 10% (8%) of enterprise lines use SIP trunking – many companies dont use it to its capacity. Europe has less penetration. UK is farther ahead. We have many competitive carriers in the US which is why we have such great growth here.

She believes that this year it will be over 10%.

Verizon predicts massive SIP trunking growth from this year to next but she is under NDA and no matter how much the room grilled her, she wouldn’t buckle.

She showed a chart of SIP trunking growth – blue portion represents North America.

Marianne Budnik introduces Zeus Kerravala of ZK Research:

Zeus: brief talk of VoIP peering – companies need to leverage employee knowledge base – determine who is available and where and when.  Collaboration between organizations such as in the medical markets and universities.

Collaboration between organizations such as in the medical markets and universities.

UC benefits are greatest when you are mobile. Integrating information between apps for example is far more useful when you cant easily cut and paste with large screens and a mouse.

Example of mobility in the enterprise: A large waste management company has delivery personnel using mobile devices – when they see a full dumpster they take a photo and send it to sales. Sales calls to see if the company wants an unscheduled pickup.

Zeus was a video skeptic but is using it more personally now. Can organizations rebuild processes with video built in?

An enterprise video example – a smaller bank is able to compete with larger ones using tablets which record video – agents go to buildings looking for financing and take photos and videos which are sent to HQ. This speeds up the loan approval process.

Brief CEBP or communications enabled business process discussion – a travel organization who is regional had the best year in 2009. They integrated videos of different destinations on their website. They then tracked movement online of where users were looking. They then proactively reached out on a targeted basis. For example, we noticed you may be considering a trip to Aruba. Close rates went from 20% to 60%!

CEBP is like the move from mainframe to browser – users didn’t know what Windows apps they wanted because they had no idea. Then they aw the GUI-based apps and the momentum started. Once enterprises see it, then they will start to deploy. There will likely be no general killer apps but perhaps vertical oriented ones like telemedicine at Johns Hopkins, etc. Mobility may be one.

Thinks SIP trunking penetration in US is under 5% and under 2% outside the US. He says vendors sell it wrong – it isnt just about cost savings. He says you should rearchitect your network when you move to SIP. You should think of how many applications you have where the functionality is local. In other words you don’t have CRM or email in every branch – then why communications? Use WAN for distribution and buy trunk lines in data centers only.

He believes business video will be a huge market – we will see much more use of it.

Many companies reduce travel budgets in conjunction with purchasing video equipment. He says but there is huge upside – in customer service for example. Being green as a driver has come and gone – it is more about travel.

3:10 pm

People understand better with video – 200% improvement in understanding using video. Schools for example use it if you miss a class. Also used by corporate training departments – sometimes the HR department purchases – not IT. 40% increase in retention and 73% of meetings end faster when you use video.

CEBP will evolve or perhaps branch off into VEBP or video enabled business process.

Tablets will accelerate UC adoption.

Another example of CEBP – in the UK they had to renew many medical cards and couldn’t do it with current staff. They put tools in to enable self-service and used chat to enable agents to deal with 4-5 people at once instead of one like the phone. They paid the integrator based on the number of transactions and allowed users to save money if they used self service. Since they had no budget they were able to use the savings to pay the contractor. They paid 4 times as much in total but considered it a win/win for all involved.

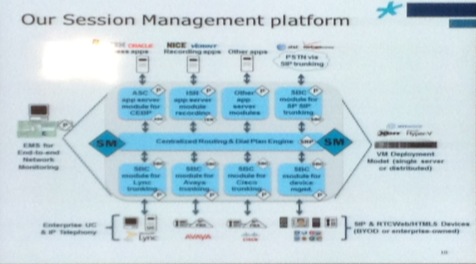

Patrick takes stage to discuss an overview of the day – the slide above shows the company’s session management platform. Lots of discussion

about how the company can grow – the relationship with Microsoft, Broadsoft, etc.

Conclusion

I am sure this event was a success in the eyes of the company. It gave them media exposure as well. The main takeaway was that complexity is not a constant, it is increasing and dramatically so. Moreover, SBCs will be essential in the world of 4G/LTE as carriers need branded voice service over this next-gen wireless solution.

Many analysts I spoke with believe the company has effectively gained a lead on others, keeping competitors from taking its customers. Sonus seems to be the biggest threat but the analysts want to see more positive quarters from the company before they feel confident they can take share of new business as opposed to upgrading existing equipment.

The reality of the the communications space is that SIP trunking is not slowing down – the SIP trunking sessions at ITEXPO (the first place in the world where such courses were offered) have been standing-room only for many years and as you can see from the above analyst comments we are in the very early days of this market which requires SBCs.

Then there is the LTE space which also requires SBCs – again, we are in the very early days with many carriers looking to learn from Verizon’s successes and mistakes.

Finally, there is the death of PSTN – TMC has hosted many sessions on this topic at past ITEXPOs and the FCC seems dead set on sunsetting your father’s and grandfather’s phone network this decade. I bring up the fact that we have hosted sessions because I get the sense that the world isn’t really aware that this will happen – or perhaps they don’t care. This means it is either too far away for anyone to take it seriously or perhaps its like when the US tried to convert to the metric system and most Americans just wouldn’t take it seriously. Perhaps prohibition is a better example – after all I am in Mass and St. Patrick’s Day is around the corner.

Andy and I discussed some of the above and we both agree the trends are very positive for the market – the reality is timing is impossible to determine in any market. If I could see the future with regards to timing I would have bought Priceline in the single digits and sold it at $650.

But SIP trunking growth around the world should provide a solid market for sales for the next decade and at some point the other two trends should be in full swing as well.

Regardless of whether I am a shareholder of a company or not I do my best to report fairly.

So I want to also point out some concerns that are worth taking seriously. The biggest challenge in the carrier space could come from a consortium of competitors working together to take share from Acme. It is difficult to determine which vendors would take part in such an alliance but the need for growth is certainly there from virtually every incumbent provider. Andy mentioned the experience/expertise/core competency may not exist at other companies but what if a Chinese vendor or two was to jump into such an alliance as well by providing cheap labor and products? Sure it may be unlikely but worth considering.

In the enterprise and SMB space, Acme is far from a household name – so there is lots of opportunity for any or all the small players in the market to take share.

And the argument that Acme has to win this market because they are dominant on the high end may not be the case because as you may recall, when IBM owned the mainframe market, DEC took over the SMB space. In other words, a market lead in one segment does not guarantee success in all segments. PR, marketing and press will help determine where the marketshare will go. And the SMB space is not as complex so this is another factor in favor of the competition.

One of the biggest fears of the analyst community was standards and CODEC consolidation – but Andy says this complexity is something he would like to see lessen. Analysts seem to think the more complexity, the better for Acme and they could be correct but there is a bewildering hodgepodge of standards – what other industry has a standard such as SIP but then has to sell SIP gateways so disparate SIP solutions can communicate with one another?

I’m not a financial analyst and trying to determine how a company will perform on a quarter by quarter basis may be one of the most challenging jobs there is. But I see macro trends and I agree with the the bullish analysts who see this sector performing well. Moreover as Acme becomes more of a partner with its customers as opposed to a box pusher and moreover moves into the cloud, there are significant opportunities for the company to continue to command a large share of a growing market.

But by the same token a company that isn’t a household name in a market leaves room for the rest of the field to grow.

But after a day of grilling company execs the analysts seem satisfied that Acme Packet is in a good position over the long haul and as one financial analyst said to me – they seem to have a mote around their business.

Disclosure: I am an Acme Packet shareholder