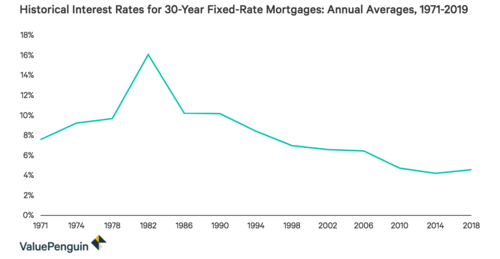

During the Carter administration, the interest rate was 18% or higher in the. The Federal Reserve at the time had to keep rates high to fight inflation – the dual mandate of the Fed is to keep inflation low and employment high.

Interestingly, in recent history, these were opposing goals. By definition, high-employment leads to upward wage pressure which in-turn causes inflation.

Moreover, government spending is stimulative which historically causes inflation. Lately, government spending is through the roof yet inflation is low or relatively tame.

Consider, the U.S. federal government spent $1,822,712,000,000 in the first five months of fiscal 2019, the most it has spent in the first five months of any fiscal year since 2009, which was the fiscal year that outgoing President George W. Bush signed a $700-billion law to bailout the banking industry and incoming President Barack Obama signed a $787-billion law to stimulate an economy then in recession.

France, is about to pass Italy as fourth most indebted country. According to Bloomberg:

Italy remained the holder of Europe’s biggest public-debt burden in 2018 even after France’s rose to almost match it. France’s debt reached 2.3153 trillion euros ($2.62 trillion), just 1.4 billion euros below its southern neighbor’s. Italy’s debt as a ratio of economic output — 132.1 percent of GDP — is also the second-biggest in the euro region after Greece, and still much higher than France’s 98.4 percent.

We’ve mentioned how low inflation is a byproduct of tech before. Amazon allows us access to products with very low margins and brutal efficiency. Google gives us free services by the dozen – there seems to be no limit to the new free or low-cost services we have access to.

Adjusted for inflation, some phone calls made 20 years ago of very poor quality, cost us over $10 per minute. They are now free, HD quality and offer video and multiparty capabilities.

Today’s surround sound systems and TVs are better than movie theatres of a few decades back.

A smartphone can cost a few hundred dollars and replace hundreds or thousands of dollars worth of equipment and services. No more need for a paper calendar, desk phone, still camera, video camera, film, film processing center, stereo system, flashlight, calculator, etc.

But most importantly, cloud is responsible for taking a machete to investment costs when launching a startup. App stores torch investments in distribution. APIs reduce the cost of building it all yourself.

AI and ML are like steroids being injected into the data economy. Historical customer interactions have never been so valuable.

In all, tech and Moore’s Law have changed the world in so many ways that the global economy seems to be able to live beyond its means like never before.

How long it can last is unknown but for the moment, tech is really allowing the global population to live a more lavish lifestyle than it can currently pay for.