With global uncertainty the norm, many carriers have struggled to get financing for new infrastructure projects and in fact they have been a bit hesitant to spend on areas other than wireless where ROI is much more predictable. Subsequently, the financial challenges facing Alcatel-Lucent, Nokia Siemens Networks, ZTE and others aren’t expected to dissipate any time soon. What may be a surprise to some though is how ZTE, a Chinese telecom equipment manufacturer with relatively low costs could have lost $414 in Q3 of this year while seeing sales drop by 13% and gross margins cut in half.

In response to this decline, China Development Bank (CDB) an entity controlled by the Chinese government has given the company a $20B line of credit at very low rates allowing it to streamline operations, continue its expansion and perhaps most importantly finance its customers’ purchases.

According to Chris Antlitz, Networking & Mobility Practice Analyst at Technology Business Research (TBR), ZTE is investing heavily in smartphones, tablets, enterprise network communications technologies, LTE-Advanced, heterogeneous networks, software and services automation and will now be able to fund resource builds, such as new Global Network Operations Centers (GNOC) to support continued growth in the managed services business.

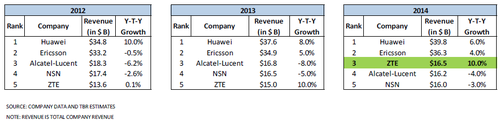

The company hopes this continued strategy of investments in technology and financing its customers will allow it to leapfrog Alcatel-Lucent and NSN to become the number three provider of telecom equipment by 2015. TBR agrees and you can see below (click to enlarge) their projected ranking of each of the major telecom vendors. They assume ZTE will grow 10% each year. They also believe Huawei and Ericsson will continue to grow but at progressively slower rates. Other vendors will see a decrease in sales according to their estimates.

The bottom line is ZTE could be the number three telecom equipment vendor in a few years thanks to the deep pockets of the Chinese government.

The challenge the non-Chinese manufacturers have is bloated infrastructure, unions and legacy costs such as pensions associated with being in business for decades. Alcatel-Lucent for its part recently secured $2.1B in financing but much of this money will go to pay debts and to buy time as the company looks to spin off assets. It’s worth noting the Paris-based company has patent assets which includes those developed by Bell Labs and the aggregate number of these valuable pieces of intellectual property is at 27,900 and counting.

Perhaps they will sell some soon? After all Kodak just landed $500M using a similar strategy.

It will be very interesting to see if politicians tackle this issue as it does seem ZTE just received a major advantage in the market and could threaten global jobs as a result. The flipside of course is with American politicians actually using the funding of GM and Chrysler as a political advantage – explaining that without the government’s help, both companies would have gone under – there really isn’t a moral high-ground in a negotiation. Then there was that whole broadband stimulus bill.

Time will tell and 2013 should be a very interesting year for the whole market as mobility usage continues to skyrocket but not all players will benefit equally from this growth.