Updated at 6:15 pm EST 2/9/11 with comments from Arunas Chesonis chairman and CEO of PAETEC at bottom

Last week at ITEXPO the rumor on the street was PAETEC may be doing a deal in India soon since Chairman and CEO Arunas Chesonis was in the country. Well it seems if this is the case it comes on the heels of another purchase – XETA technologies was just picked up by the company today.

I know what you’re thinking – the company is on a mission to roll-up all other companies who use all caps in their names.  Of course you are only partially right as PAETEC sees strong synergy here as XETA is a large reseller of Avaya, HP, Juniper, LifeSize and Mitel gear with a strong focus on the healthcare, financial and retail markets.

Of course you are only partially right as PAETEC sees strong synergy here as XETA is a large reseller of Avaya, HP, Juniper, LifeSize and Mitel gear with a strong focus on the healthcare, financial and retail markets.

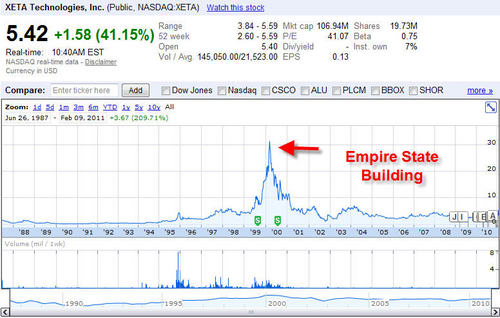

For Xeta, the move makes sense as its long-term chart looks like the Manhattan skyline just after the Empire State Building was built – basically a massive valuation around the Y2K/dotcom time frame when most companies were installing new gear. Other than that it has been mostly in the $2-$3 range for the last five years or so. As of this writing the stock is up $1.58 or 41% to $5.42.

Long-term stock performance of XETA technologies

So for XETA an exit makes good sense and for PAETEC, they get a chance to add to their cloud services as XETA offers managed solutions in security, training, telephony management, end-user support and more.

Still at a P/E of 41, the valuation of a company making most of its living rolling trucks seems high. But then again a pure-play cloud company like Salesforce.com trades at a sky-high 244 times.

For PAETEC this purchase is about expanding its reach and relationships as well as the managed services aspects of the deal. Moreover, the company has a large new channel which will carry the Allworx product line. Chesonis says in a press release that this move is partially motivated by th vertical markets XETA focuses on – hospitality, education, healthcare and government – but this is enough verticals to make the company a horizontal reseller – sure manufacturing is left out but what sane businessperson is focusing here if they don’t have to?

This move is smart for both companies and so far PAETEC’s stock is up 3 cents to $4.15 which means the street probably likes the news or they don’t think it is big enough to make a big difference.

PAETEC did not immediately respond to emails on any acquisition or other plans in India.

Updated as referenced above:

According to Chesonis, another reason for the purchase was they could bring the company’s Quagga business – an acquisition on June 8, 2010 and make it national overnight. Moreover, the fact that Xeta is located in Tulsa where the company has one of its large data centers was a factor in making this deal more attractive.

The head of PAETEC called me from Las Vegas where the Quagga user conference is taking place and he says the timing of this deal was great as the audience was buzzing. Moreover he says some Quagga founders came from XETA and both businesses share common business process principles and are growing in double-digits.

Moreover, both have been on the Avaya advisory council. Chesonis believes the enterprise value of $65M is fair for XETA and the close should take place in April or May of this year.

He further sees integration of managed services and cloud where the former is more telecom oriented and the latter is more of an IT function. He also beleives the larger channel – with more feet on the street means the thousand partners the company has amassed as interconnects and VARs will likely start to consider giving more of their network business to PAETEC instead of other carriers.

Chesonis confirmed the rumor I heard at ITEXPO about a potential India deal. He explained how he went to Mumbai recently with some board members to potentially do a deal which he said could be in Canada, the UK and/or India. The goal being to support current customers in the US. As he explained, he couldn’t tell me if anything is imminent but he did say this was his first trip to India and the best part was the food.